XinFin (XDC) Price Prediction 2025–2030: Can XDC Break $1?

XinFin’s XDC token is rapidly emerging as one of the most promising enterprise-grade blockchain assets. Built to power global trade and finance, XinFin bridges traditional systems with decentralized technology through its hybrid blockchain model.

As the global economy explores tokenized assets and cross-border digital payments, investors are keen to know whether XDC could reach the $1 mark by 2030. In this guide, we’ll analyze XinFin’s price trends, technical and fundamental factors, and long-term forecasts.

Current Market Overview

Current Price: ~$0.07897 USD

Market Cap: ~$959.8 million USD

24-Hour Trading Volume: ~$54.3 million USD

Market Rank: Top 100 cryptocurrencies

Trend: Consolidating after a mild correction phase

Recent Developments

Strategic partnership with R3 Corda for enterprise blockchain interoperability.

Collaboration with Launchpool to accelerate Web3 startups on the XDC ecosystem.

Focus on real-world asset (RWA) tokenization, positioning XDC for future trade finance innovation.

These updates strengthen XinFin’s real-world utility, helping the project gain traction among institutional users and developers alike.

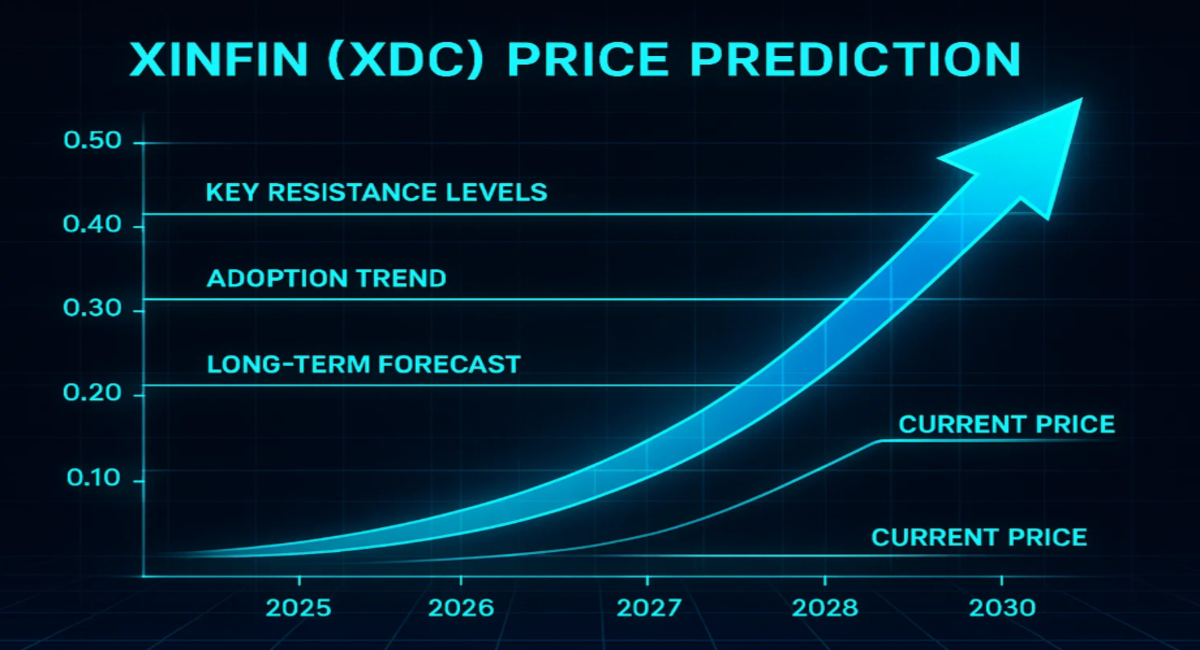

XDC Price Prediction (2025–2030)

Short-Term / Weekly Outlook

Scenario | Forecast Range | Key Drivers |

Bearish | $0.06 – $0.07 | Global crypto correction, uncertain macro trends |

Neutral | $0.075 – $0.085 | BTC dominance stabilization, consolidation period |

Bullish | $0.09 – $0.12 | Positive sentiment, partnership news, rising demand |

If XDC maintains support above $0.07 and breaks past $0.10 resistance, it could trigger a short-term bullish recovery.

Long-Term Price Forecast

Year | Conservative | Base Case | Bullish |

2025 | $0.10 – $0.15 | $0.15 – $0.25 | $0.25 – $0.35 |

2026 | $0.12 – $0.20 | $0.25 – $0.40 | $0.40 – $0.60 |

2027 | $0.18 – $0.30 | $0.35 – $0.60 | $0.60 – $1.00 |

2028 | $0.25 – $0.45 | $0.50 – $0.85 | $0.85 – $1.50 |

2029 | $0.35 – $0.60 | $0.70 – $1.20 | $1.20 – $2.50 |

2030 | $0.50 – $0.90 | $1.00 – $1.75 | $1.75 – $3.00+ |

Summary: Under ideal adoption and macro conditions, XinFin (XDC) could potentially surpass $1 by 2030, supported by enterprise blockchain growth and increased token utility.

Technical Analysis

Key Technical Indicators

Support Zones: $0.05 and $0.07

Resistance Levels: $0.10, $0.12, and $0.15

RSI (Relative Strength Index): Neutral (~50), showing healthy consolidation.

MACD: Near a bullish crossover, signaling possible upward movement.

Moving Averages: Price testing 50-day MA — breakout above may confirm trend reversal.

Beginner-Friendly Insight

When XDC trades above both its 50-day and 200-day moving averages, it often signals the start of a new bullish phase. If RSI stays between 45–60, the token remains in a healthy accumulation zone for long-term investors.

Fundamental Analysis

1. Adoption & Ecosystem Growth

XinFin operates a hybrid blockchain — combining the speed of public networks with the privacy of private chains. This design is ideal for trade finance, global settlements, and enterprise integrations.

2. Key Partnerships

R3 Corda – Connecting traditional enterprises to decentralized frameworks.

Launchpool – Empowering startups via token-based community funding.

Ongoing initiatives in RWA tokenization and fintech collaborations.

3. Developer & Community Activity

XinFin maintains a robust development cycle, upgrading interoperability and dApp functionality. The community actively supports ecosystem growth through education and integrations.

4. Tokenomics

Max Supply: 37.7 billion XDC

Circulating Supply: Majority already in the market

Controlled emission ensures minimal inflation, aiding long-term price stability.

Should You Invest in XinFin (XDC)?

Pros

Backed by an enterprise-grade blockchain utility.

Low transaction costs and high efficiency via XDPoS consensus.

Increasing adoption in global trade tokenization.

Energy-efficient and environmentally friendly design.

Cons

Faces competition from other Layer-1 and hybrid blockchains.

Enterprise adoption may progress more slowly than retail-driven projects.

Subject to crypto market volatility and regulation shifts.

Verdict

XinFin (XDC) is a technically sound and fundamentally strong project that focuses on practical blockchain applications. While it may not provide rapid short-term gains, its long-term potential remains promising — especially as enterprise blockchain adoption accelerates.

Conclusion

XinFin (XDC) continues to strengthen its foothold in the global trade finance ecosystem, offering a hybrid model that balances security, scalability, and interoperability.

With continuous partnerships, increasing developer activity, and a clear focus on real-world use cases, XDC could emerge as a key player in blockchain-based finance by 2030.

However, as with all crypto investments, it’s crucial to stay updated, diversify your portfolio, and trade responsibly.

Buy or Trade XinFin (XDC) on BuyUcoin

If you believe in the future of hybrid blockchain and real-world asset tokenization, XinFin (XDC) is worth your attention.

With BuyUcoin, you can start trading XDC instantly using INR, UPI, or Bank Transfer — securely and seamlessly.

BuyUcoin is FIU-registered, ensuring a safe, transparent, and regulatory-compliant trading experience for Indian investors.

Start your XDC investment journey today! Sign Up & Trade XinFin (XDC) on BuyUcoin