Cryptocurrency has transformed from a niche technological experiment into a global financial phenomenon. From retail investors in India to institutional funds worldwide, digital assets are increasingly becoming part of mainstream financial conversations.

But what exactly is cryptocurrency? How does it work? Why do people invest in it? And what risks should you understand before entering this market?

This comprehensive guide answers these questions in a simple yet technically accurate way—so that aap informed decisions le sakein, especially if aap BuyUcoin jaise trusted Indian platform ke through crypto explore karna chahte hain.

What Is Cryptocurrency?

Cryptocurrency is a form of digital or virtual currency that uses cryptographic techniques for security and operates on decentralized networks built on blockchain technology.

Unlike traditional money issued by governments (like INR or USD), cryptocurrencies are:

Not controlled by a central authority

Operated on distributed computer networks

Secured using advanced cryptographic protocols

Transparent and publicly verifiable (in most cases)

The first and most well-known cryptocurrency is "Bitcoin", introduced in 2009. It laid the foundation for thousands of other digital assets that followed.

How Does Cryptocurrency Work?

To understand cryptocurrency, you have to know about blockchain:

What Is Blockchain Technology?

Blockchain is a distributed digital ledger that records transactions across multiple computers in a secure, transparent, and immutable manner.

Here’s how it works in simplified steps:

A user initiates a transaction.

The transaction is broadcast to a network of computers (called nodes).

The network validates the transaction using consensus mechanisms.

The validated transaction is added to a block.

The block is permanently added to the blockchain.

Once recorded, the data cannot be altered without consensus from the entire network—making it highly secure.

Consensus Mechanisms

Cryptocurrencies use consensus algorithms to validate transactions. The two most common are:

Proof of Work (PoW) – Used by Bitcoin

Proof of Stake (PoS) – Used by Ethereum

These mechanisms ensure trust without needing a central authority.

Types Of Cryptocurrencies

The crypto market includes thousands of digital assets, but they can broadly be categorized into the following groups:

1. Payment Cryptocurrencies

These are designed primarily as digital money.

Bitcoin

Litecoin

They aim to function as decentralized alternatives to traditional currencies.

2. Smart Contract Platforms

These allow developers to build decentralized applications (dApps).

Ethereum

Solana

They power ecosystems including DeFi, NFTs, and Web3 applications.

3. Stablecoins

Stablecoins are cryptocurrencies pegged to stable assets, such as the US Dollar, to minimize price volatility.

Tether

USD Coin

They are often used for trading, hedging, and transferring value efficiently.

4. Utility Tokens

These provide access to a specific blockchain-based product or service.

Examples include tokens used for:

Governance voting

Transaction fee payments

Ecosystem participation

5. Meme Coins

These originate from internet culture and community-driven trends.

Dogecoin

Shiba Inu

Official Trump

While popular, they are typically more volatile and speculative.

Benefits Of Cryptocurrency

Understanding the advantages is essential before investing.

1. Decentralization

Cryptocurrencies operate without central banks. This reduces the risk of single-point failures and censorship.

2. Transparency

All transactions on public blockchains are visible and traceable.

3. Global Accessibility

Anyone with internet access can participate. This promotes financial inclusion—especially in emerging economies like India.

4. Fast Cross-Border Transfers

Crypto transactions can settle faster compared to traditional international banking systems.

5. Portfolio Diversification

Many investors use crypto as an alternative asset class to diversify beyond equities, gold, or fixed income.

Risks Of Cryptocurrency

While potential benefits are strong, risks must not be ignored.

1. Market Volatility

Crypto prices can fluctuate significantly within short timeframes.

2. Regulatory Uncertainty

Regulations vary across countries and may evolve. In India, crypto is taxed, but regulated frameworks continue to develop.

3. Security Risks

Improper wallet management, phishing attacks, and scams can lead to asset loss.

4. Technological Complexity

Understanding private keys, wallets, and blockchain mechanics requires basic digital literacy.

5. Liquidity Risk In Smaller Tokens

Not all cryptocurrencies have deep liquidity, making price swings more dramatic.

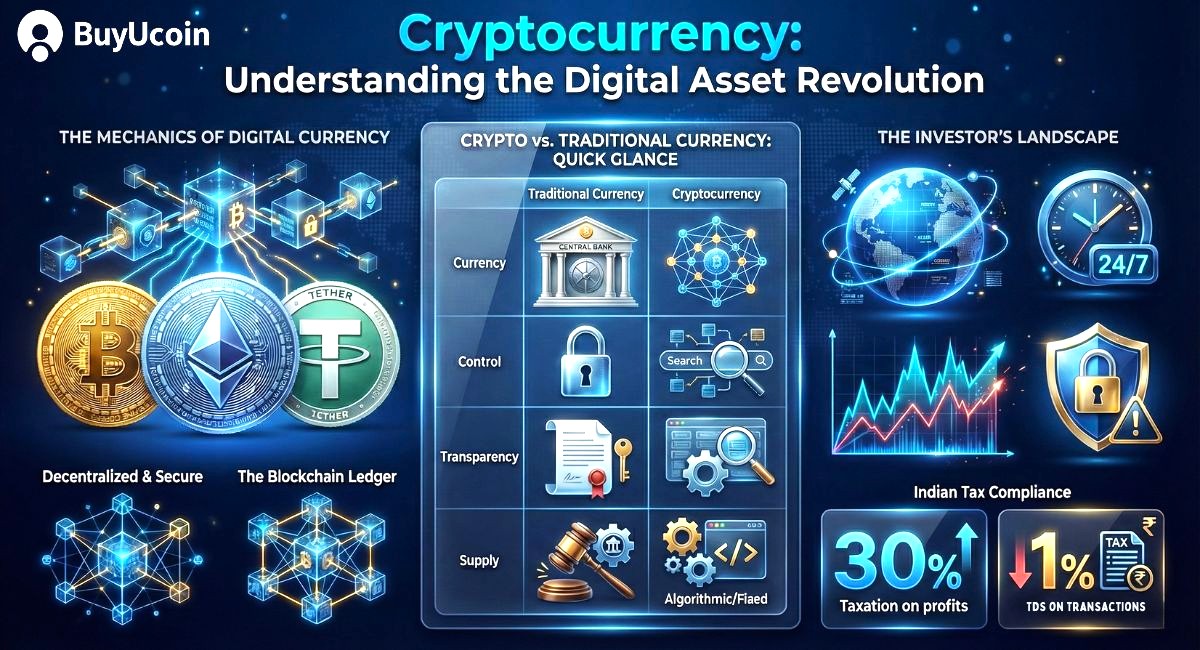

How Is Cryptocurrency Different From Traditional Currency?

| Feature | Traditional Currency | Cryptocurrency |

|---|---|---|

| Issued By | Central Banks | Decentralized Network |

| Physical Form | Yes | No |

| Transaction Speed | Moderate | Often Faster |

| Supply Control | Central Authority | Algorithmic |

| Transparency | Limited | Public Ledger |

This fundamental difference explains why crypto is often referred to as “digital gold” or “internet-native money.”

Is Cryptocurrency Legal In India?

Cryptocurrency trading is legal in India. However:

Profits are subject to taxation.

A 30% tax applies to crypto gains.

1% TDS applies to certain transactions.

Investors should remain compliant with Indian tax regulations while participating responsibly.

How To Buy Cryptocurrency Safely In India

If you are a beginner, it is important to follow a structured approach:

Choose a reliable Indian crypto exchange.

Complete KYC verification.

Deposit INR securely.

Start with well-established cryptocurrencies.

Use secure wallet practices.

This is where BuyUcoin becomes relevant.

Why Buy Cryptocurrency Through BuyUcoin?

BuyUcoin is among India’s established digital asset platforms offering:

User-friendly interface for beginners

INR deposit support

Wide selection of cryptocurrencies

Transparent fee structure

Secure compliance-based onboarding

For investors who prefer a regulated Indian platform experience, BuyUcoin provides a simplified entry into crypto markets.

Should You Invest In Cryptocurrency?

Investment decisions depend on:

Risk tolerance

Investment horizon

Financial goals

Portfolio diversification strategy

Crypto is considered a high-risk, high-reward asset class. Experts often recommend allocating only a small portion of the total portfolio to this asset class.

A disciplined, research-based approach is critical.

The Future Of Cryptocurrency

Cryptocurrency is evolving beyond speculation.

Current global trends include:

Institutional participation

Central Bank Digital Currency (CBDC) experimentation

Blockchain adoption in supply chain and finance

Tokenization of real-world assets

As technology matures, crypto infrastructure is becoming more scalable, and regulatory clarity is gradually improving.

India’s growing digital economy may also play a key role in long-term crypto adoption.

Frequently Asked Questions (FAQs)

Is cryptocurrency safe to invest in India?

Cryptocurrency carries risk due to volatility. Investing through secure platforms and maintaining proper risk management improves safety.

How much money do I need to start investing in crypto?

Many platforms allow small INR investments, making crypto accessible to beginners.

Can cryptocurrency replace traditional money?

Currently, cryptocurrencies complement traditional systems rather than replacing them entirely.

Is Bitcoin the only cryptocurrency?

No. Thousands of cryptocurrencies exist, including Ethereum, stablecoins, and ecosystem-specific tokens.

Do I need technical knowledge to invest in crypto?

Basic understanding is helpful, but platforms like BuyUcoin simplify the process for beginners.

Final Thoughts

Cryptocurrency represents a technological shift in how value is stored and transferred digitally. It combines cryptography, decentralized governance, and blockchain innovation into a new asset class.

However, it is not a guaranteed path to quick wealth. Responsible investing, regulatory awareness, and platform security are critical.

If you want to explore crypto with clarity and compliance, starting with BuyUcoin provides a structured and user-friendly experience.

Start Your Crypto Journey With Confidence

Digital assets are reshaping global finance. Instead of staying on the sidelines, take a research-driven step forward.

Create a verified account on BuyUcoin today, explore leading cryptocurrencies securely, and begin your investment journey with transparency and control.