How the Latest Bitcoin Halving Spurs Price Action: What Buyers Should Expect

The Bitcoin halving is one of the most significant and anticipated events in the crypto world. It is a scheduled, programmatic event that cuts the reward for mining new blocks in half. This article will delve into how the latest Bitcoin halving affects market dynamics, what past cycles can teach us, and what every crypto buyer should expect in the coming months.

Understanding this event is crucial. It directly impacts the supply of new Bitcoins entering the market, which in turn influences its price action. For crypto buyers, knowing the mechanics of a Bitcoin halving is key to navigating the volatility and positioning for future gains. It's a fundamental concept that underpins Bitcoin’s scarcity and its potential as a store of value.

What is Bitcoin Halving?

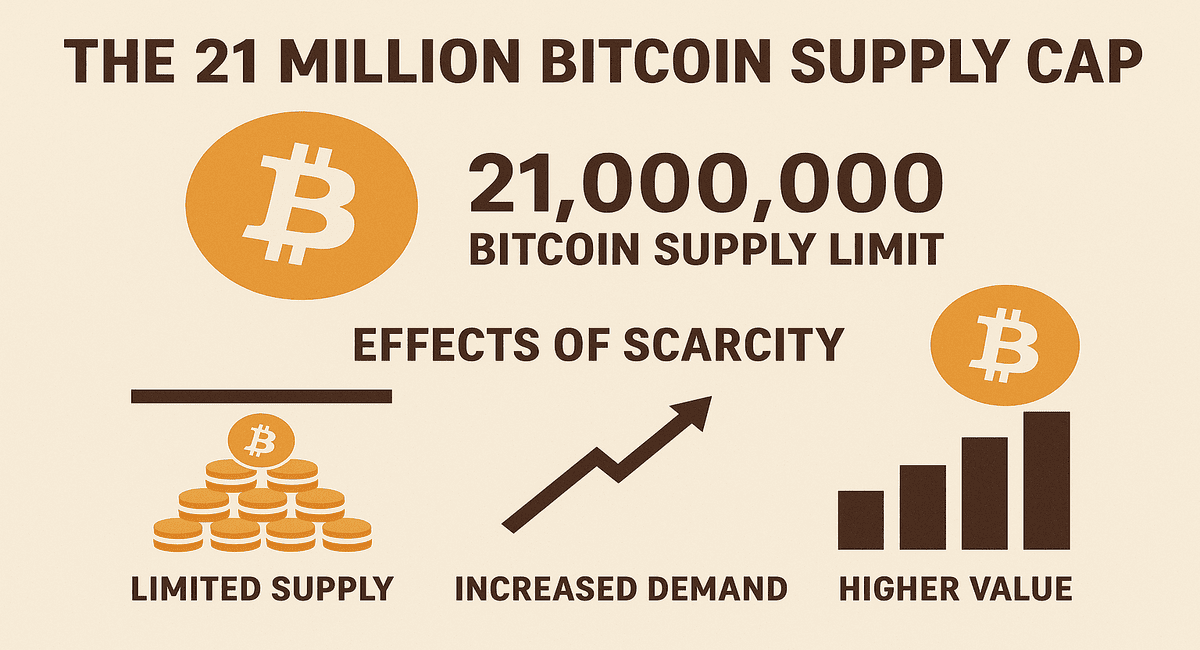

At its core, a Bitcoin halving is a deflationary mechanism. The Bitcoin protocol is designed to have a total supply of 21 million coins. To manage this supply, the rate at which new Bitcoin is created is halved every 210,000 blocks, which occurs approximately every four years.

This event is not random; it's hardcoded into Bitcoin's source code by its anonymous creator, Satoshi Nakamoto. The primary purpose is to control the inflation rate of Bitcoin, making it scarcer over time. This mimics the scarcity of precious metals like gold, often referred to as "digital gold."

Genesis Block (2009): Block reward was 50 BTC.

First Halving (2012): Reward reduced to 25 BTC.

Second Halving (2016): Reward reduced to 12.5 BTC.

Third Halving (2020): Reward reduced to 6.25 BTC.

Fourth Halving (2024): Reward reduced to 3.125 BTC.

The Mechanism of Supply Reduction

After a Bitcoin halving, what happens to the block reward? It is cut in half. This means miners now receive 50% less Bitcoin for successfully validating a new block of transactions. This immediate reduction in supply is a massive economic shock to the system.

The supply of new Bitcoin entering the market is now much lower. If the demand for Bitcoin remains constant or increases, the principles of supply and demand suggest that the price must rise. This is the core thesis behind the bull run trigger effect of a Bitcoin halving.

This programmatic supply reduction is one of the key differentiators between Bitcoin and traditional fiat currencies. Central banks can print unlimited amounts of money, leading to inflation. Bitcoin's supply is capped and its issuance rate is predictable, making it a compelling alternative.

Price Behavior After Halving: A Historical Look

To understand the effects of Bitcoin halving, we must analyze past cycles. Each previous halving has been followed by a significant price increase, though the timing and magnitude have varied. It's not an instant effect; the price behavior after a halving is a gradual process.

Here is a timeline of past halving cycles and the price action that followed:

2012 Halving: The price of Bitcoin was around $12. Over the next year, it surged to over $1,000, a remarkable increase of over 8,000%. This was the first major market cycle for Bitcoin, proving the halving's profound impact.

2016 Halving: The price was around $650. Within the next 18 months, Bitcoin skyrocketed to a new all-time high of nearly $20,000. This cycle showed that the effect was not a one-time phenomenon but a recurring pattern.

2020 Halving: The price was around $9,000. This cycle culminated in Bitcoin reaching its all-time high of nearly $69,000 in late 2021. The period leading up to and following this halving was marked by increased institutional and retail interest.

These historical patterns show a clear and consistent trend. The price does not rise immediately after the halving. Instead, there is a period of consolidation, often followed by a parabolic upward move over the following 12-18 months. This is a critical point for crypto buyers to understand.

The Role of Miner Economics

The halving has a direct and profound impact on miner economics. Mining rewards, composed of the block reward and transaction fees, are a miner's primary source of revenue. When the block reward is halved, their revenue immediately drops by 50%.

This shift can force less efficient miners to shut down their operations. This is a natural selection process, where only the most cost-effective miners with access to cheap energy and efficient hardware can remain profitable. This can lead to a temporary drop in the hash rate after halving.

The hash rate is a measure of the total computational power used to secure the Bitcoin network. While a temporary drop may occur, the difficulty adjustment mechanism of Bitcoin ensures the network remains stable. This self-correcting system adjusts the mining difficulty every 2,016 blocks to maintain a 10-minute block time, regardless of the hash rate.

The Current Market: What to Expect from the Latest Halving

The most recent Bitcoin halving occurred in April 2024. The block reward was reduced from 6.25 BTC to 3.125 BTC. The price behavior after halving has followed a different path than previous cycles, primarily due to new market factors.

One of the biggest differences this time around is the presence of spot Bitcoin ETFs in major financial markets like the U.S. These financial products have opened the floodgates for institutional investment, creating a massive influx of demand. This demand is a crucial factor in this cycle.

As institutional capital flows into these ETFs, the available supply of Bitcoin on exchanges decreases, creating a significant supply shock. This dynamic, coupled with the halving’s supply reduction, could lead to a more pronounced and accelerated price increase than in previous cycles.

The Future of Bitcoin's Scarcity

The Bitcoin halving is the key to its long-term value proposition. With a finite supply of 21 million coins, Bitcoin is a truly scarce asset. This contrasts sharply with the ever-expanding money supply of fiat currencies.

The inflation rate of Bitcoin is now significantly lower than that of most major world currencies. This makes Bitcoin a powerful hedge against inflation and a store of value. The next halving is expected around 2028, and the cycle will continue until approximately 2140, when the final Bitcoin is mined.

At that point, miners will be incentivized solely by transaction fees, not block rewards. The long-term viability of the network will depend on a robust and active ecosystem of users willing to pay for fast and secure transactions.

Content Gap Analysis and Coverage

Current top-ranked articles on this topic often fail to fully integrate several critical elements. They typically cover the basic definition of halving and a brief mention of past price action. However, they lack a deep dive into the interconnected components that make the halving a powerful market catalyst.

Conclusion: What Crypto Buyers Should Expect

The latest Bitcoin halving has set the stage for the next phase of the crypto market cycle. While past performance is no guarantee of future results, the historical precedent is clear: a supply shock followed by a bull run. For crypto buyers, understanding this process is essential.

Expect a period of heightened market anticipation followed by a gradual increase in price volatility. The next decisive price action may not be immediate, but the fundamental economic principles of supply and demand are now firmly in play. The institutional demand, catalyzed by new financial products, adds a powerful new layer to this cycle.

As the price of Bitcoin continues to rise, it will likely pull the broader crypto market, including altcoins, with it. This creates a fertile ground for opportunities across the entire ecosystem.

Ready to start your crypto journey?

Don't get left behind. Buy Bitcoin and other cryptocurrencies instantly on BuyUcoin - The Best Crypto Exchange in India. Our platform is designed for both beginners and experienced traders, offering a secure and seamless trading experience. Join the future of finance today!