Bitcoin is currently consolidating within the lower-$13,000 region as bulls move to control its near-term price action.

It has been struggling to break above $13,200 ever since it was rejected at this price level a few days ago. This currently marks the crypto’s 2020 high, and the selling pressure here is quite significant.

If broken above, this level could spark a serious uptrend that sends it flying higher, with it potentially reaching up towards $14,000 before it faces any further selling pressure.

It did face a slight rejection at these highs earlier today, and they may continue stopping it from seeing any intense upwards momentum in the short-term.

One analyst is noting that Bitcoin’s monthly candle – which will close in exactly one week – is currently incredibly strong.

He believes that a close above $12,500 could create serious momentum that allows BTC to fly past the $13,000 region’s resistance. A break above this resistance zone would put a move to its all-time highs on the table.

Bitcoin Shows Signs of Strength as Bulls Target 2020 Highs

At the time of writing, Bitcoin is trading up just under 2% at its current price of $13,150. This is just a hair below its 2020 highs of $13,200 set a handful of days ago.

The selling pressure in this region is quite intense and may continue to stop it from seeing any further upside in the near-term.

That being said, the rejection that BTC sees each time it tests this resistance is progressively growing weaker. This indicates that bulls are chipping away at the selling pressure here, which may mean that a break above it is imminent in the near-term.

Analyst: A Monthly Close Above This Key Level Will Rocket BTC Higher

While sharing his thoughts on where Bitcoin might trend in the near-term, one analyst explained that its upcoming monthly candle close – set to take place in one week – will be crucial for understanding its macro outlook.

He hypothesizes that a close above $12,500 will help provide BTC with a strong base to grow upon, potentially putting a move to fresh highs on the table.

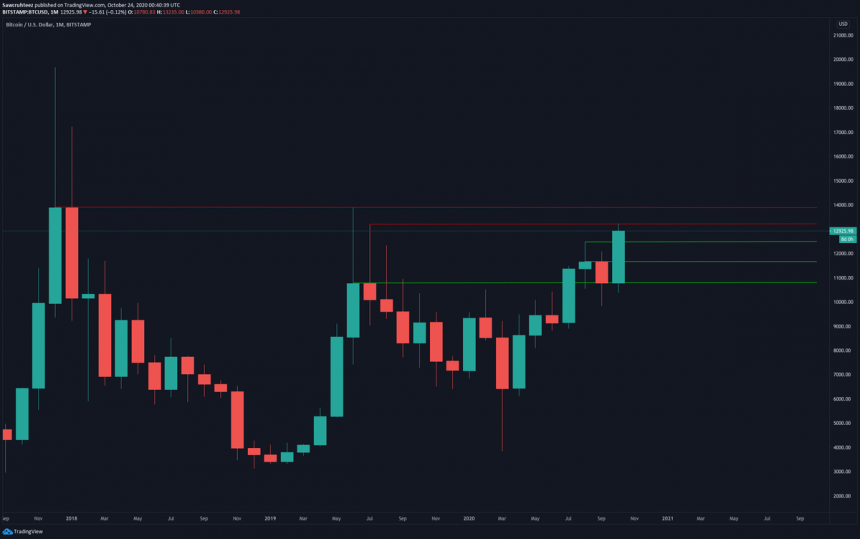

“Here are my monthly levels for BTC. Seeing significant resistance from $13,200 – $13,900 but if we can close October above $12,500 then Houston would be ready for another countdown.”

Image Courtesy of Tyler Coates. Chart via TradingView.

The coming week will be vital for understanding Bitcoin’s macro outlook.

Featured image from Unsplash. Charts from TradingView.

1% Deposit Bonus & Withdrawal Fees On Crypto Deposit in BuyUcoin

Read More

A Decade in the Making: US SEC Approves 11 Bitcoin ETFs, Igniting Market Enthusiasm

Read More

Will Bitcoin Price Increase 200% When Bitcoin ETF Is Approved?

Read More

10 Must-Have Features on Bitcoin Staking Site

Read More

Christmas in the cryptocurrency world arrives early as the pre-holiday crypto market heats up

Read More