Yearn.finance’s YFI governance token has been inching closer and closer to the $30,000 level for the past few days and weeks, with the selling pressure here proving to be somewhat significant on multiple occasions.

Overall, the crypto’s price is currently caught within a holding pattern similar to that seen by Bitcoin and Ethereum,

Until the larger digital assets breakout – or breakdown – and gain clearer momentum there’s a strong possibility that YFI will continue consolidating as well.

Despite it not being able to break above $30,000 just yet, its technical outlook is growing brighter by the day.

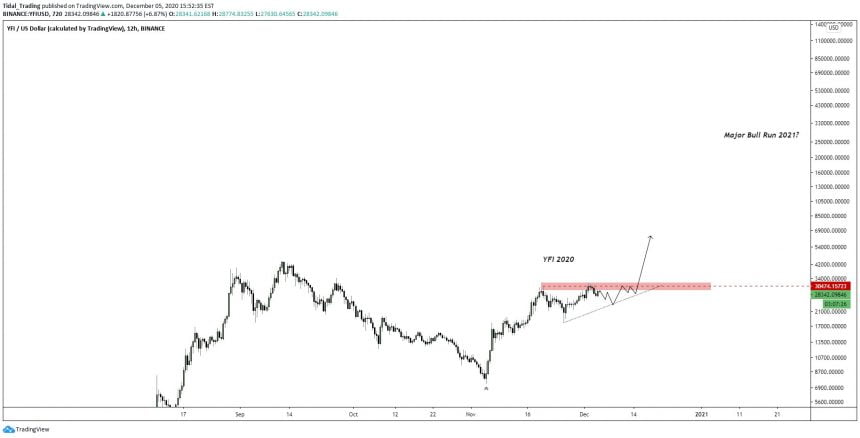

One trader is now noting that Yearn.finance’s current technical structure reminds him strikingly of Ethereum’s in late-2016. At this time, the crypto saw a consolidation phase that resulted in a breakout with parabolic momentum.

If history rhymes and YFI sees a similar breakout in the days and weeks ahead, there’s a strong possibility that the cryptocurrency could enter another price discovery phase that results in it seeing some parabolic momentum.

This momentum will likely extend well into 2021, according to the analyst. He reckons that it will see similar price action during this period as ETH did throughout 2017.

Yearn.finance Inches Higher as Investors Closely Watch $30,000

At the time of writing, Yearn.finance’s YFI token is trading down just over 3% at its current price of $28,400. This is around the price at which it trading throughout the past week.

For a brief moment, it climbed as high as $32,000 before it met some serious resistance and plunged lower.

It has been closely tracking the overall trends seen by Bitcoin and Ethereum as of late, making it imperative that these assets rally higher for it also to see further gains in the mid-term.

Trader Claims YFI Could Be Mirroring a Bullish ETH Fractal

One trader stated in a recent tweet that Yearn.finance’s YFI token could be in the process of mirroring a highly bullish Ethereum fractal from 2016, which would indicate that 2021 will be an incredibly positive year for the DeFi benchmark.

“Get the feeling YFI is gonna pull a late 2016 $ETH and build up insane pressure in the form of an ascending triangle and blast off into price discovery during late December-early January whilst the real bull run plays out in 2021 (2017 for ETH).”

Images Courtesy of HornHairs. Source: YFIUSD on TradingView.

Where the entire market trends in the mid-term will depend on Ethereum and Bitcoin. These two digital assets have been guiding the DeFi market, which means that Yearn.finance’s fate is at least partially in their hands.

Featured image from Unsplash. Charts from TradingView.