Yearn.finance’s embattled YFI governance token has been caught within a relentless downturn as of late that has been induced by immense sell-side pressure, a fragmented community and declining protocol value.

The culmination of these various bearish factors has led analysts to expect significantly further downside in the near-term.

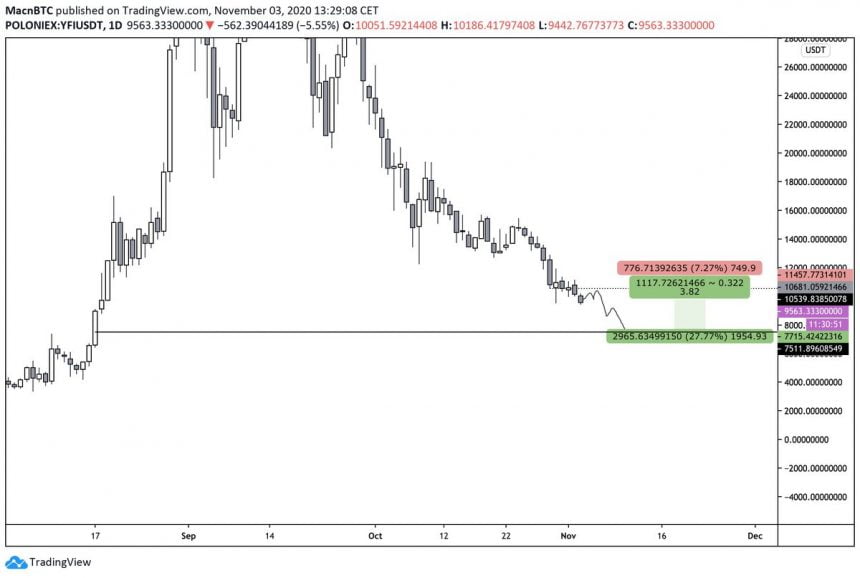

One trader is now noting that a decline towards $7,500 is likely imminent due to its inability to find any strong momentum as it slides beneath $10,000.

One recently passed governance proposal could bolster its outlook, as it redistributes the protocol’s income so that it goes towards market buying YFI tokens that can be used as community incentives.

It remains unclear whether or not this will create much buy-side pressure for the token, as the protocol’s earnings have been drying up due to limited liquidity rewards on platforms like Curve.

Yearn.finance’s YFI Struggles to Gain Momentum

Over the past few weeks, Yearn.finance’s YFI has been sliding lower and struggling to gain any momentum.

Bears have been in full control of its price action ever since it peaked at highs of $45,000 in early-September.

These highs came about in tandem with the DeFi sector’s peak, and the relentless selling pressure placed on YFI in the time since has been emblematic of the sector’s weakness.

At the time of writing, Yearn.finance’s YFI token is trading down just under 6% at its current price of $9,400.

This is around the price at which it has been trading throughout the past few days and weeks.

Because it is now trading firmly below its key $10,000 support level, there’s a decent chance that significantly further downside could be imminent in the near-term.

Trader Targets Move to $7,500 as YFI Shows Continued Weakness

YFI’s recent weakness is showing few signs of slowing down, as each relief rally has been heavily sold into.

Until the Yearn.finance ecosystem can begin capturing more value and directing that value towards those staking in the yVaults, there’s a strong possibility that further downside will be imminent.

One analyst stated in a recent tweet that he is targeting a move down towards $7,500 in the near-term.

“YFI – Short retest of $10,250. Target $7500,” he said while pointing to the below chart.

Image Courtesy of Mac. Source: YFIUSD on TradingView.

Unless there are serious underlying changes to the Yearn.finance ecosystem, there’s a strong possibility that further downside is imminent.

Featured image from Unsplash. Charts from TradingView.