An important fundamental health signal of the Bitcoin network just crossed into “capitulation” territory, which in the past was associated with downside risk. However, the tool’s creator says that it wasn’t designed to give sell signals, and shouldn’t be interpreted that way.

But because of how profitable its been used as a buy signal over the cryptocurrency’s history, it is difficult to ignore a sudden anomaly in the asset’s market cycle that has never in the past appeared. So what exactly is going on and why did this rare signal just trigger?

What Gives? Bitcoin Hash Ribbons Signal Miner Capitulation As Bull Market Begins

There is no other asset on the face of the planet like Bitcoin. Altcoins created in its honor, and even hard forks that as closely mimic the first ever cryptocurrency as possible can’t come close to its market share dominance and potential.

Cryptocurrencies in general, share very few similarities with traditional assets like stocks. Due to this, the fundamental analysis methods typically used to forecast company share pricing are useless.

Related Reading | Bitcoin Dominance Is Days Away From Triggering A 30% Rally Against Alts

Instead, custom tools have been designed by experts like Charles Edwards that closely monitor specific Bitcoin network health metrics, such as hash rate, and more. Edwards also created the hash ribbons, which in the past have acted as the ultimate buy signal for the top cryptocurrency.

Its signals are few and far between, but it has notably provided the runway for the rally to Bitcoin’s all-time high, and again to $14,000 both recent attempts.

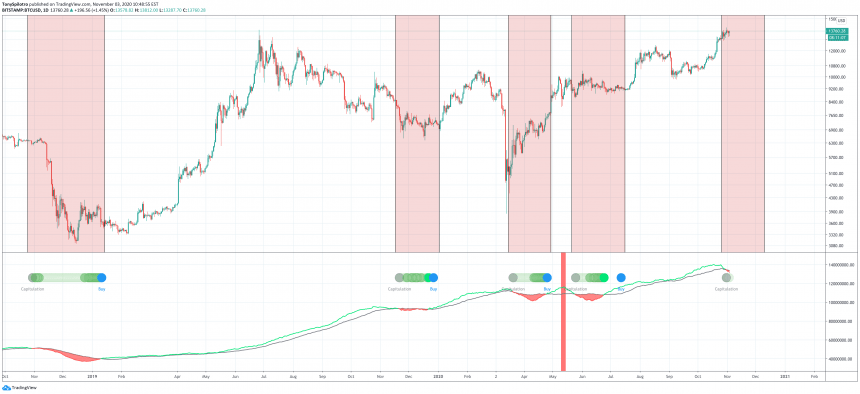

The hash ribbons indicator is signalling that miners are capitulating, but why? | Source: BTCUSD on TradingView.com

On average, hash ribbon buy signals result in roughly 5,000% return. But before the buy signal takes place, BTC miners must capitulate, which the hash ribbons signal with a crossover to the downside.

The tool’s creator warns that capitulation isn’t a signal to sell, but is it foolish to ignore a signal that in the past has been associated with some of the cryptocurrency’s most signfiicant downside?

Reminder: Hash Ribbon capitulation is not a sell signal.

It never was.

— Charles Edwards (@caprioleio) October 30, 2020

Rare Capitulation Signal Appears For First Time Ever Post-Halving, But Why?

Since 2019 alone, this makes the fourth time miners have capitulated according to the hash ribbons. The first in 2019, was when Bitcoin fell to $6,000 in late December.

Black Thursday happened so fast, capitulation in this case came after the collapse itself. During this time, the top crypto asset traded way below the cost of production – another BTC fundamental tool Edwards has created.

Another captiulation event happened post-halving, just as the cost of production spiked above price action, but Bitcoin price quickly caught up.

Now, capitulation in BTC miners is back in the air. Most instances led to downside, some even severe. Prior to 2019, capituation of miners sent Bitcoin plummeting to its current bear market bottom of $3,200.

The hash ribbons indicator is signalling that miners are capitulating, but why? | Source: BTCUSD on TradingView.com

Crypto investors find comfort in comparing the last market cycle against the current, expecting similar results. However, according to the hash ribbons, things are already vastly different.

During the last bear market, the hash ribbons triggered three times. The short-lived bear market before it in 2012-2013 also had three distinct triggers.

Related Reading | Crypto Analyst: Altcoins To “Tank” While Bitcoin Runs For All-Time High

This time around, however, Bitcoin is working on its fifth time. Black Thursday was an acceptable anomaly that created an extra fourth fallout capitulating miners, but what is causing a fifth time? And will this be the final buy signal before the bull run when BTC miners have completed capitulating?

Each round of capitulation, in theory, shakes out weak miners leaving only the strongest to survive, in turn strengthening Bitcoin’s network and making the bull market more sustainable.

So even if Edwards is wrong and the tool can spot sell signals also, when the buy trigger arrives, it could be an opporotunity of a lifetime.

Note: To learn more about Bitcoin fundamental tools, including the hash ribbons indicator created by Charles Edwards, check out the recently launched NewsBTC crypto trading course.

Featured image from Deposit Photos, Charts from TradingView.com