XRP has barely moved more than a few cents away from an average of 25 cents for months, while on the Bitcoin trading pair, the asset has continued to fall.

But while altcoins are bleeding out against BTC, Ripple whales continue to accumulate and the soaking up of the supply could soon cause an enormous breakout against Bitcoin.

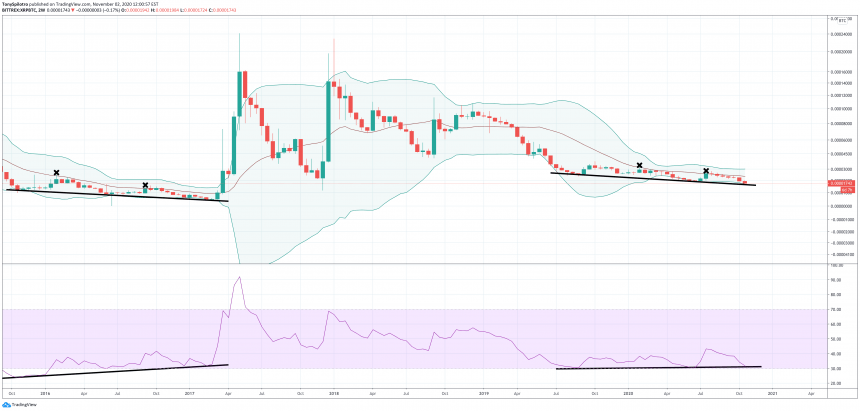

XRP Versus BTC: Bollinger Bands Squeeze Into Hidden Bullish Divergence

It is hard to imagine an asset of any type is bullish when it is currently falling and setting new downtrend lows. But sometimes, there’s more going on behind the scenes, building up pressure for a massive move eventually and a change in behavior.

Ripple, has now spent nearly three full years falling on its ratio compared to BTC. Since mid-2019, XRP has done very little but trade mostly sideways while grinding ever lower.

Related Reading | XRP Triggers Signal Resulting In Nearly 80% On Average Rise Against Bitcoin

The long consolidation range has resulted in the Bollinger Bands squeezing on two-week timeframes, to the second tightest point in the trading pair’s history.

History doesn’t always repeat, but it often rhymes. And if a hidden bull div on the Relative Strength Index on the same timeframe matching the last time the Bollinger Bands contracted this tight is any indication, an explosive reversal against Bitcoin is near.

The last time around, after a second rejection from the middle-BB, third time was the charm and Ripple lifted off, rising over 2,000% against BTC.

The Bollinger Bands are squeezing, gearing up for a big move. Hidden bull div on RSI points to up | Source: XRPBTC on TradingView.com

Whales Accumulating Ripple Resemble Bitcoin Metrics Before Breakout

Although the exact same scenario isn’t a given, silent accumulation of XRP whales matches the same sort of behavior as Bitcoin did before its recent breakout.

Whale-sized BTC wallets increased consistently until there wasn’t enough supply to go around, and Bitcoin had a major bullish breakout recently.

Related Reading | Underdog Story: Why Ripple Could Soon Outperform Bitcoin And Ethereum

Now, it could be Ripple’s turn. According to data, XRP wallets with 1 million or more have increased by 20%, while wallets with 10 million or more have grown by 10%.

When these whales finally decide they’ve soaked up enough supply, prices increase rapidly as investors try to catch the breakout. When XRP does finally break out, its moves are substantial, and the signs above are anything to go by, overperformance against Bitcoin could be coming soon.

Featured image from Deposit Photos, Charts from TradingView.com