Yearn.finance’s YFI governance token has been caught within a consolidation phase as Bitcoin, and the rest of the crypto market, also see some short-term sideways trading.

This lack of momentum has come about due to the DeFi sector’s stagnating growth, with investors largely sitting on the sidelines while they wait for capital to rotate out of lower-risk assets like Bitcoin and into the high beta DeFi markets.

Until traders and investors alike grow confident that upside is imminent for the aggregated crypto market, there’s a strong possibility that higher risk fractions of the market will continue struggling.

This could prove to be bearish for Yearn.finance’s YFI, as it has seen stagnating growth as of late due to a combination of a disengaged and embattled community, low yields on their various vaults, as well as a weak technical situation.

The confluence of these factors could continue hampering its technical prospects in the days and weeks ahead.

That being said, one analyst is noting that there’s one level that could soon be broken above that may allow YFI to “stretch its wings” and rally higher.

Yearn.finance’s YFI Struggles to Match Gains Seen by Bitcoin and Ethereum

At the time of writing, Yearn.finance’s token is trading down over 6% at its current price of $13,440.

This is around the price at which it has been consolidating for the past couple of weeks, with bulls facing massive inflows of selling pressure each time they try to push it higher.

It is now trading just a hair above its strong base of support at $13,000 established throughout the past few weeks.

If this level continues to be defended in the days and weeks ahead, it could act as a strong base for YFI to grow upon in the weeks ahead.

Analyst: YFI Could Rally Higher If It Breaks One Crucial Level

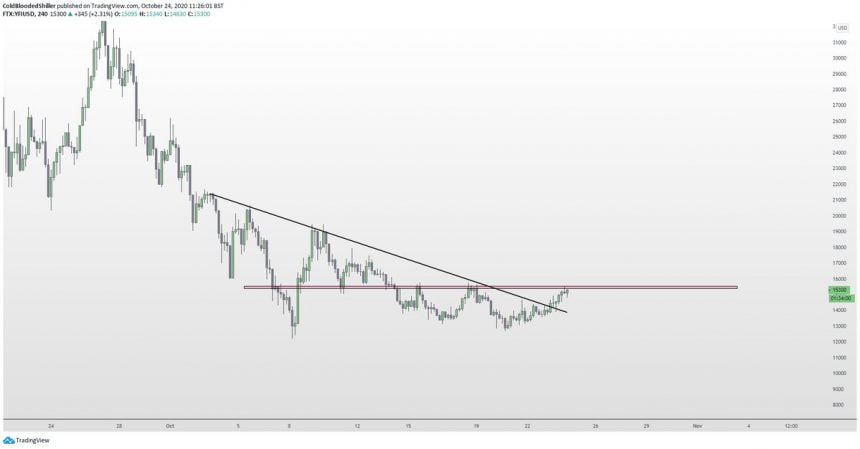

While speaking about the cryptocurrency’s technical outlook, one analyst observed yesterday that $15,300 is the crucial level that must be broken and held above for Yearn.finance’s YFI to see greater momentum.

This level was broken for a short while over the weekend, but it faced a serious rejection here that sent it reeling to its current price.

“Break through the top of this immediate resistance and we could easily see it stretch it’s wings again.”

Image Courtesy of Cold Blooded Shiller. Source: YFIUSD on TradingView.

Where it trends in the near-term will likely depend on the aggregated DeFi sector, which means it is vital for Yearn.finance (YFI) that Bitcoin and Ethereum maintain their strength.

Featured image from Unsplash. Charts from TradingView.