Yearn.finance’s YFI has been caught within the throes of an intense uptrend throughout the past few days, with its recent lows of $7,500 looking more and more like a long-term bottom as money keeps flowing into the altcoin market.

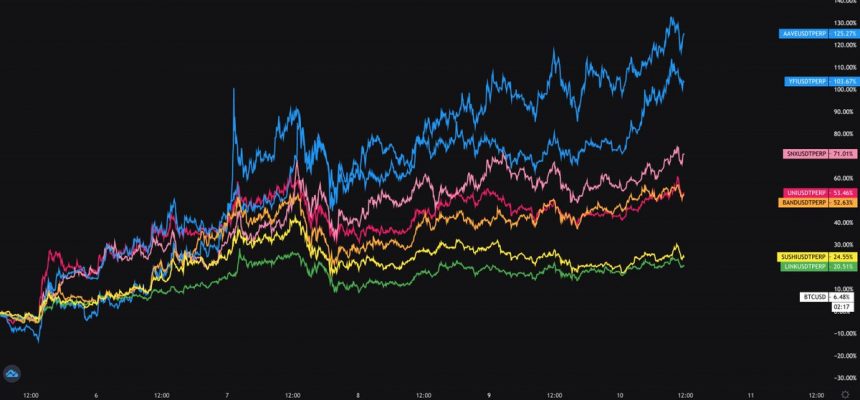

In particular, DeFi tokens have seen immense strength throughout the past few days, with the blue-chip tokens all rallying in tandem.

Bitcoin and Ethereum have been consolidating concurrently with this explosion in the DeFi sector, which signals that investors may largely be rotating capital away from the larger digital assets and into higher beta plays.

This trend is confirmed by the fact that the rallies seen by these tokens as of late have come about in the absence of any fundamental changes. yVault yields remain rather low, and the income being produced by the protocol isn’t too high.

That being said, yVault yields may start rising as trading volume shifts once again away from centralized exchanges and towards Uniswap.

It is important to note that of all the “blue-chip” DeFi projects, Yearn.finance is currently the best performing over the past few days and weeks.

Yearn.finance’s YFI Rallies Towards Recent Highs as DeFi Market Rebounds

At the time of writing, Yearn.finance’s YFI token is trading up over 15% at its current price of $17,400. This is a massive rise from its one-week lows of $7,500 set just a few days ago.

The crypto had previously seen immense weakness that came about due to heavy sell-side pressure and stacked short positions on margin trading platforms.

The breakout rally that led it from $7,500 to highs of $18,000 in a matter of hours liquidated most of these short positions and has provided it with a good base to grow upon.

YFI Leads Aggregated DeFi Market Higher

Yearn.finance’s YFI is widely viewed as a benchmark for the entire DeFi space. As such, its recent uptrend has revitalized the entire sector.

Currently, out of all the top DeFi tokens, YFI is by far the best performing. It is up well over 100% from its recent lows and is showing few signs of slowing down anytime soon.

One analyst spoke about its performance in a recent tweet, saying:

“Friendly reminder all bluechips are not created equal. My pocket rockets continue to be YFI and AAVE for the foreseeable future, coincidentally also the top performers of this cycle so far.”

Image Courtesy of Hsaka. Source: TradingView.

If Yearn.finance’s YFI can break above $20,000 next, this could spark a second wave of DeFi mania that sends many tokens rocketing higher.

Featured image from Unsplash. Charts from TradingView.