Yearn.finance’s YFI token saw a sharp capitulatory decline overnight that caused it to post some massive losses. This decline briefly sent it below $10,000, which is a level that had not been broken below since weeks before its parabolic move to $45,000 started.

This decline has come about amidst a capitulatory bout of panic selling amongst altcoins, as many are trading down 20% or more today while Bitcoin continues consolidating.

Part of this weakness may stem from Ethereum’s intense underperformance, as it is now trading below $380 while BTC pushes past $13,300.

YFI has been able to get some relief, however, as the break below $10,000 was rapidly absorbed and followed by a sharp upswing that sent it to highs of $11,500.

It now appears to be consolidating as its bulls look to build a strong base of support around its recent lows.

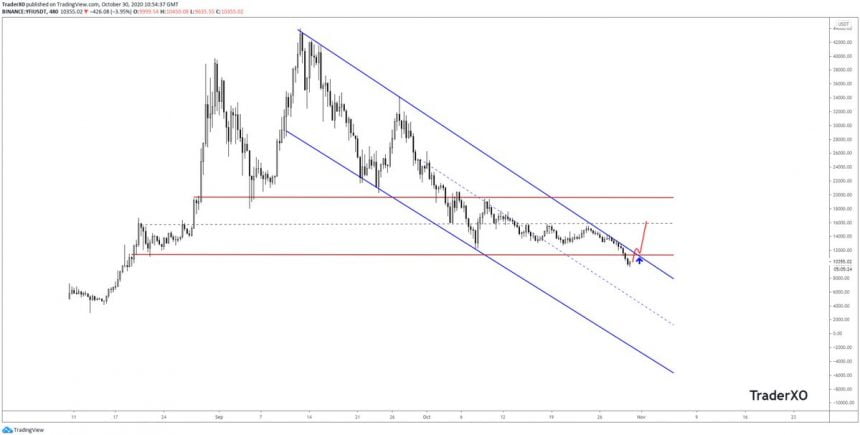

One analyst is noting that this range reclaim is bullish and could indicate that a push towards $13,000 or $14,000 is imminent in the near-term.

This would be a serious rebound that helps negate some of the technical weaknesses resulting from this latest decline.

Yearn.finance Price Craters Below $10,000 During Brief Overnight Selloff

At the time of writing, Yearn.finance’s YFI token is trading up just over 2% at its current price of $11,000. This is around where it has been trading all morning following its brief decline to lows of $9,750.

The selling pressure it faced last night was intense and likely came about due to a mixture of panic selling and capitulation.

Where it trends next will undoubtedly depend largely on whether or not bulls can guard against another decline.

Analyst: YFI Could Rally Towards $14,000 Following Bullish Range Reclaim

While sharing his thoughts on Yearn.finance’s price action, one analyst explained that he is watching for YFI to rally up towards $13,000 or $14,000 following a bullish range reclaim.

He pointed to this technical development in a recent tweet, noting that a failure to print a sharp upwards movement would be grave.

“YFI: Range reclaim – might get a long back upto 13-14k. Blue arrow trigger, otherwise doesn’t look good – price capped nicely within the down trending channel,” he said.

Image Courtesy of TraderXO. Source: YFIUSD on TradingView.

Yearn.finance’s YFI has become a benchmark for the DeFi sector, so a strong rebound could create shockwaves across the market that allow other altcoins to rally in tandem.

Featured image from Unsplash. Charts from TradingView.