Components of Chainlink

So first, let’s begin with something that we know is the most important piece of Chainlink, the service agreement, which involves staking, which involves decentralizing the entire network of Oracle nodes.

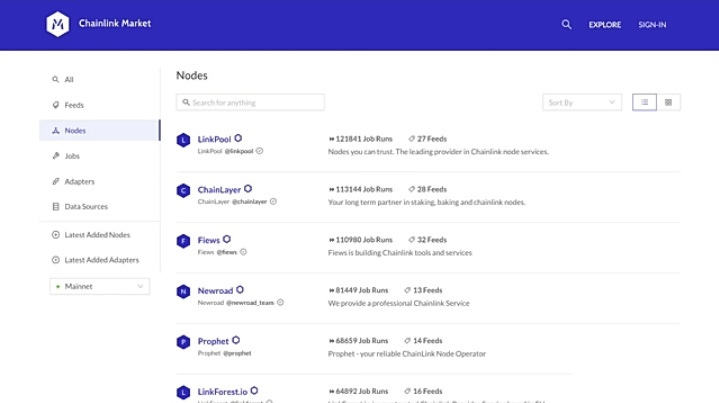

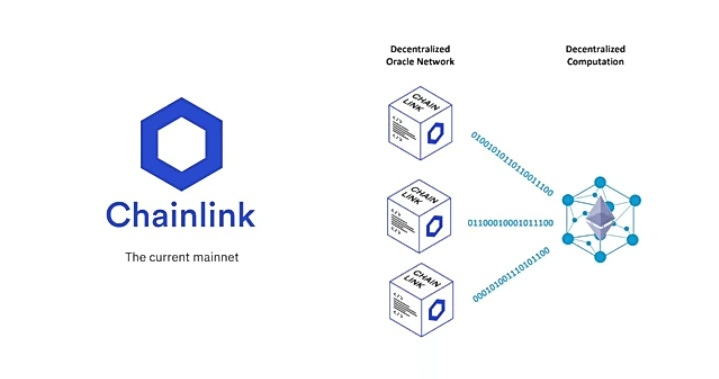

So if you didn’t know Chainlink is live for trading, the main net there is a network of Oracle nodes providing data to requesters. Chainlink Market has a great list, a breakdown of the nodes, and the data request jobs they have run link pools.

Twenty-seven data feeds and over one hundred and twenty-one thousand jobs ran chain layer twenty-eight data feeds and over one hundred and thirteen thousand jobs are in Few’s.

11,100 jobs ran with 32 data feeds and the list goes on. But right now, since there is no service agreement and sticking with the nodes, that chain link maybe not fully decentralized yet.

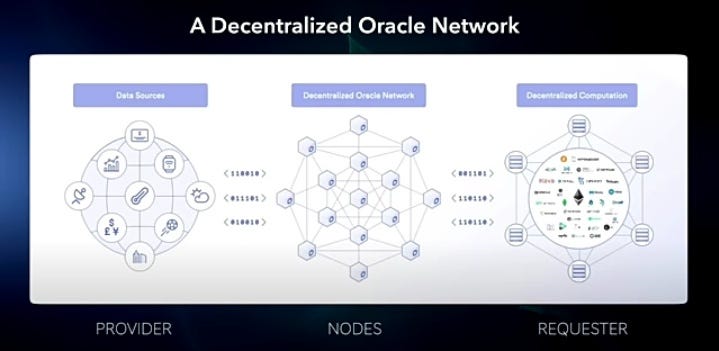

Decentralized Computation Network

The service agreement contracts are not required for the early version of the Chainlink main net. Currently, node operators can still accept jobs and get paid EnLink tokens for completing said jobs.

But no upfront tokens will be required to accept the job and therefore there is currently no ability to stake. Nor do the nodes require any link tokens on them as collateral.

So right now, requesters are still paying the node operators to retrieve data and reach consensus on the data that is provided. So as of right now, it works like this.

Requesters from the world of the applications and more each web three, a.k.a. the Decentralized Computation Network. They need data. It submits a job request in the form of a smart contract to the chainlink network of Oracle nodes.

And those nodes get the data from the providers to who they are connected, and then the nodes connected to the data providers the requester wants reach consensus on that data that is provided and then send it back to the requester in the decentralized computation network.

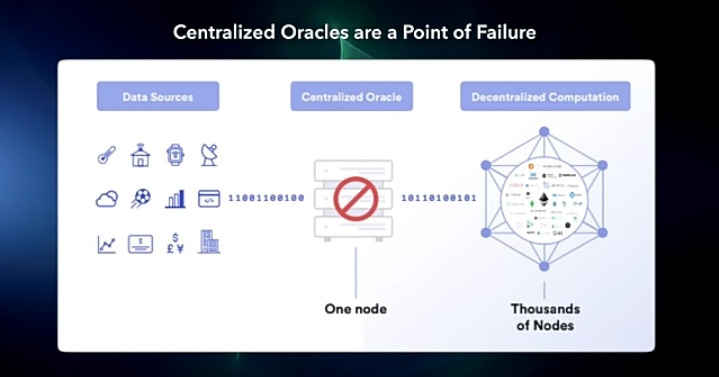

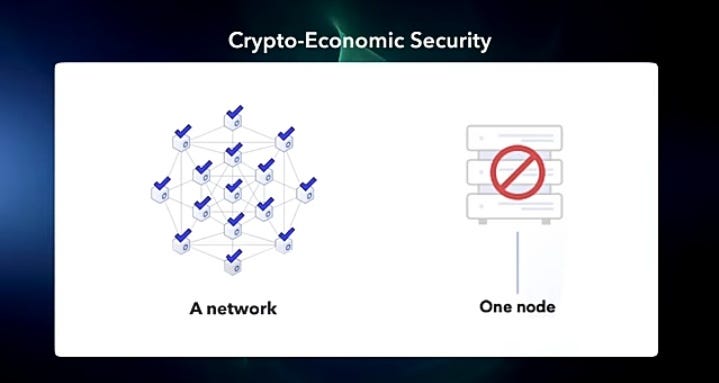

So you’re not using a single node to get the data, a single point of failure, and creating centralization and smart contracts which are supposed to be decentralized, including the daps running.

Then you can’t have decentralized computation without decentralized oracles. So right now we do have decentralization in providing data back to the requesters, the world of Web three, and computation.

Decentralization and Security

But since the service agreement and staking aren’t there yet, there isn’t a way to be fully stressless with the node operators as they don’t get penalized for bad data or bad uptime.

But those service agreements and the staking that come with it make number one, both the node commitment and performance of the note on-chain and fully verifiable.

Number two, oracles who deviate from their commitments have an immediate economic loss from their stake. And number three, oracles who can’t fulfill their commitments won’t be selected for other job quorums losing out on a ton of potential revenue.

So staking and chain link is about decentralization, but not in the sense of coming to a consensus. Taking is about creating crypto-economic security for data. Requesters can trust the network and not a single entity.

And when this launches is when the chain-link goes nutty. Buddy, in my opinion, why do you ask what? Since the jobs they are running likely have to do with a lot of money, the Oracle node operators in the network have to stake that dollar value in link with their node.

Remember immediate economic loss from their stay? Yes, that is so they don’t provide bad data to, say, a derivative contract worth hundreds of millions of dollars.

What you’re saying hundreds of millions of dollars in chain link will be staked by node operators when the service agreement goes live? Yeah, I’m kind of saying that as during a baseline protocol meeting, it was dropped.

How much value is being secured right now in the current version with chain-link nodes? Let’s listen in here. We send in the framework and a network of operators records then who can reach a consensus on specific data points.

So and when we discussed General, it was very clear. Basically, Gawronski, Cendant is being used by around twenty-three applications, which are based on experience. We get price data, mostly price data, which is a different kind of use case, and it’s guaranteed security.

Explicit and Implicit Stacking

The greater functions are securing around a few hundred million dollars of value, basically. Yeah, hundreds of millions. So when the service agreement goes live, we should see hundreds of millions of dollars in chain link-state right away.

And then the flagman himself, Serguei, decided to do a long presentation on Chain Link, titled The Evolution of Smart Contracts and Crypto Economic Security. And guess what? He explained the staking that is coming.

He said: To say now this is also highlighted by what happens when a service agreement in our system releases stake in proof of stake systems where the staking often goes to networks or it’s burned or something else happens to it.

In their case, many of the service agreements will likely go to the smart contract developers and in some cases might even be giving it to users because the service agreement is meant to guarantee a very specific outcome around data delivery to a specific contract under the extremely specific conditions defined in the service agreement.

So once again, we’re focused on data delivery, highly secure systems for data delivery. There are many forms of stake. There systems we consider having an explicit stake and implicit stake. Their node operators might have a certain amount of Lincoln.

They might stake another certain amount of links for specific contracts. So the stake rewards, they will be paid out based on that service agreement. It could be right back to the node. It could be developers, it could be the users of the app.

It could be just Staker’s with a note or combinations of the like. And chain link is going to support two types of staking implicit and explicit. Implicit is what it stands for. Implied but not plainly expressed.

No to operators and chain links have a stake in the network. If they deviate from the protocol, the asset they hold chainlink will decrease in value. If they provide good data and don’t, GVA chain links will increase.

An explicit stake is just that stated clearly for specific contracts. But the combination of the two explicit and implicit creates a bulletproof economic security layer or the chain link network.

Tracking Chainlink

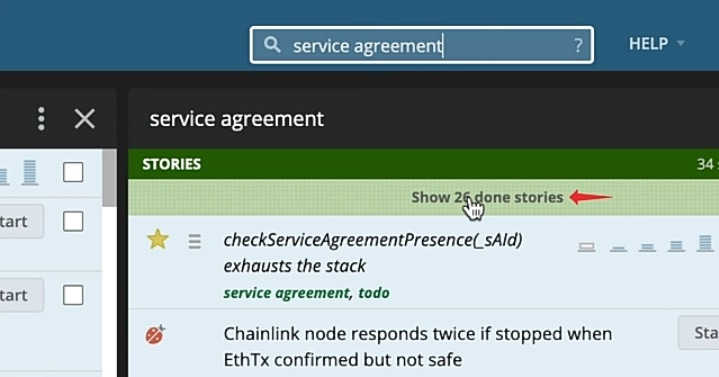

So when is this coming? Well, you should have this weblink saved if you’re a link head like me, that chain link, pivotal tracker.

So this is where the chain-link development is tracked and we can search by the service agreement, see what has been completed. Typing that into a search project. We find all the tasks that have been completed.

As you can see, there are twenty-six done stories, arc development path. So let’s check a few of them out. A specific done story is this one the service agreement initiator that is done so agreement they can be initiated.

Service Agreement

How about tests? Have tests been done with the service agreement? As we can see, the ad service agreement, the integration test is done and completed. And finally, we can see the last thing completed regarding the service agreement was adding agreement aggregators into the service agreement.

But then we get into the icebox, the blue. These are the stories that have not been scheduled. As we can see. Basically, there is fifty percent to go regarding the service agreement.

But the fact is this Sergei is speaking about it on a deeper level and it leads me to believe the staking and service agreement is about to get a development sprint and we will see many tasks in the icebox be scheduled and start turning green.

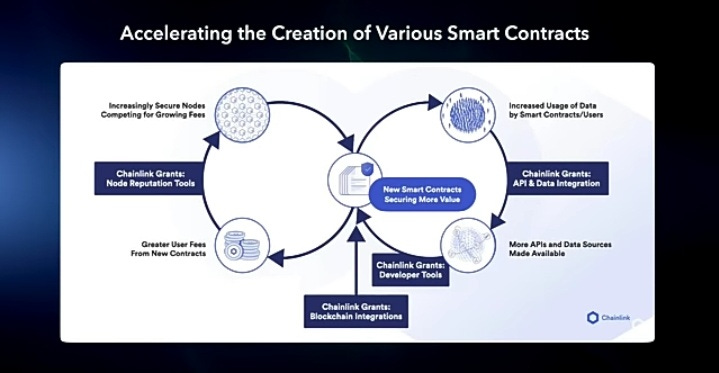

Smart Contract

Now, the thing we need to worry about in the meantime is the growth of the chainlink network, the node operators, data providers, and the requesters, because when it goes live, the service agreement, will create a self-reinforcing loop between all of these, which will be hard to beat in the Oracle space.

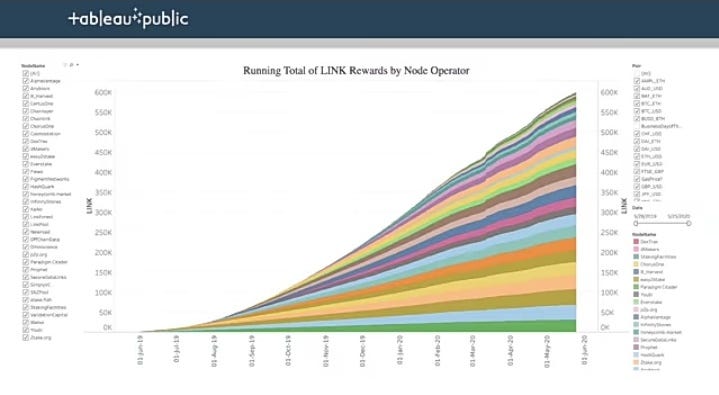

And we can visualize this. The network growth with link rewards being paid out, the more linked being paid out to the nodes, the bigger the growth of the network all around.

And just look at the growth since the launch of the main net exponential with now over six hundred K linked tokens paid out since launch and the data put together by Crypto Sponge, it ended on May 25th so we wouldn’t doubt another fifty K tokens has been paid out since.

Fidelity

And you guys, this is just five crypto-related stuff. We aren’t even talking about the outside world, some of the chain link major enterprise partners and them diving in. So you guys, you know, Fidelity, they have a branch into cryptocurrency with Fidelity digital assets.

Well, Fidelity has some patents out there regarding smart contracts and blockchain data matching Oracle’s and Fidelity. They manage two point four trillion dollars in assets.

And guess who is a part of ISEE three together? Chain Link and Fidelity Labs, the ones who file patents for Fidelity, as we can see from their website. Two hundred plus since its founding in nineteen ninety-nine.

As we can see from this old article, Fidelity started their patent program at twenty twelve. So hundreds of millions right now versus trillions that could be coming in the future for chain links down the road.

Yes, but seeing patents filed by Fidelity Labs, who has been working alongside Chainlink, see three since 2017. Yeah. We hope you get the picture. Cheers.

Read Also:- Yearn.finance’s $140M yETH vault proves investors are ravenous for DeFi