Crypto traders rely on several tools to help predict future Bitcoin price action and trend changes. Few tools have been as reliable over the years as the TD Sequential indicator, created by market timing expert Thomas Demark.

The few times this tool has failed on the highest timeframes, Bitcoin has absolutely exploded in the months following. Is this time different and the sell signal its giving will be reliable? Or will this be the last chance to buy Bitcoin below its former all-time high of $20,000?

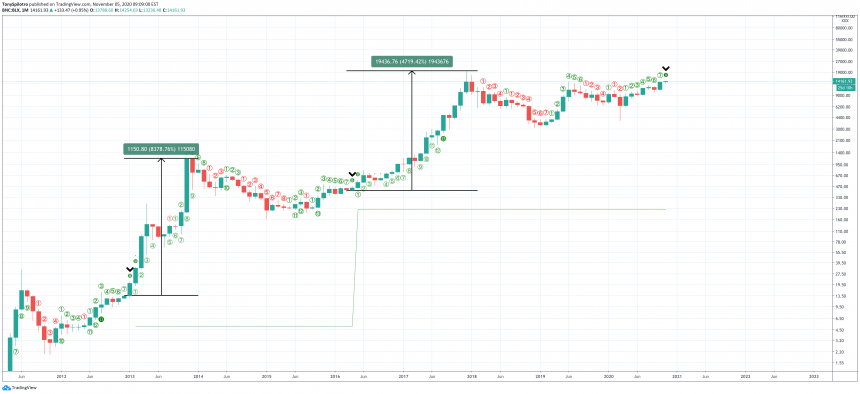

Bitcoin Triggers Rare Sell Signal That Once Failed Kicked Off The Bull Market

Bitcoin is one of the most volatile assets historically, due to its speculative nature and rise from literally nothing to nearly $20,000 in 2017.

The cryptocurrency is picking up steam again, and another bull market could be beginning. As the first of its kind, Bitcoin is just over a decade old and has only two previous bear markets to go on.

But both of those two previous bear markets, ended when the TD Sequential indicator on monthly timeframes, perfected an “8” sell setup, prior to also perfecting a “9” set up as well.

Related Reading | Bitcoin Quickly Approaches $15,000 As Election Outcome Lingers

Typically, a TD 9 signal suggests trends are nearing exhaustion, and the tool has been reliable all throughout the bear market on daily and weekly timeframes at calling tops and bottoms in Bitcoin and altcoins.

The highest timeframe signals are also usually the most dominant and effective when predicting the future trend. In the last two cases, however, the TD Sequential failed miserably on monthly time frames at calling the top, causing investors to potentially miss out on an over 8,000% rally.

Now, the signal is back, but is this time different?

The monthly TD Sequential indicator has perfected an “8” sell setup, and a “9” could be next | Source: BLX on TradingView.com

Fool Me Twice: Don’t Fall For the TD Sequential In A Crypto Bull Market

In 2013, when the TD Sequential indicator perfected an “8” and “9” sell setup, doing so would have been a grave mistake. Selling there would have missed an 8,000% rally.

Years later, when the more extended bear market ended, Bitcoin exploded by another 4,700% after the perfected setups. Again, selling would have been disastrous as an investor. During the 2017 rally, the TD Sequential even triggered a “13” countdown sell setup, which means the trend is severely overextended.

Related Reading | Bitcoin Hash Ribbons Trigger Rare Bull Market Capitulation Signal

Yet, it still couldn’t take Bitcoin down, and instead spiked from $3,000 to $20,000 five months later.

The TD “8” has been perfected, and another higher high next month would perfect the “9.” Then it is watch and wait, to see if the sell signal works this time or if another multi-thousand percent impulse move follows.

Featured image from Deposit Photos, Charts from TradingView.com

1% Deposit Bonus & Withdrawal Fees On Crypto Deposit in BuyUcoin

Read More

A Decade in the Making: US SEC Approves 11 Bitcoin ETFs, Igniting Market Enthusiasm

Read More

Will Bitcoin Price Increase 200% When Bitcoin ETF Is Approved?

Read More

10 Must-Have Features on Bitcoin Staking Site

Read More

Christmas in the cryptocurrency world arrives early as the pre-holiday crypto market heats up

Read More