Discover the top three market-leading Bitcoin apps for European investors, with a clear look at self-custody, recurring purchases, and payment methods.

Bitcoin apps have become a core entry point for European investors looking to buy and accumulate bitcoin without relying on traditional exchanges. While many platforms bundle bitcoin alongside stocks, ETFs and altcoins, a growing segment of users prefers apps that focus on simplicity, long-term savings and clear custody models.

This guide reviews three of the most relevant bitcoin apps available to European investors.

Quick Takeaway

- Bitcoin apps enable investors to seamlessly buy, trade, and save in bitcoin.

- Relai stands out as a Bitcoin-only app built for simplicity, beginner-friendliness, its easy-to-set-up savings plan, and its self-custody wallet.

- Revolut and Bitpanda offer access to bitcoin as part of broader multi-asset platforms.

What Are the Best Bitcoin Apps in Europe?

The following apps stand out in Europe, particularly for their ease of use and suitability for various types of investors.

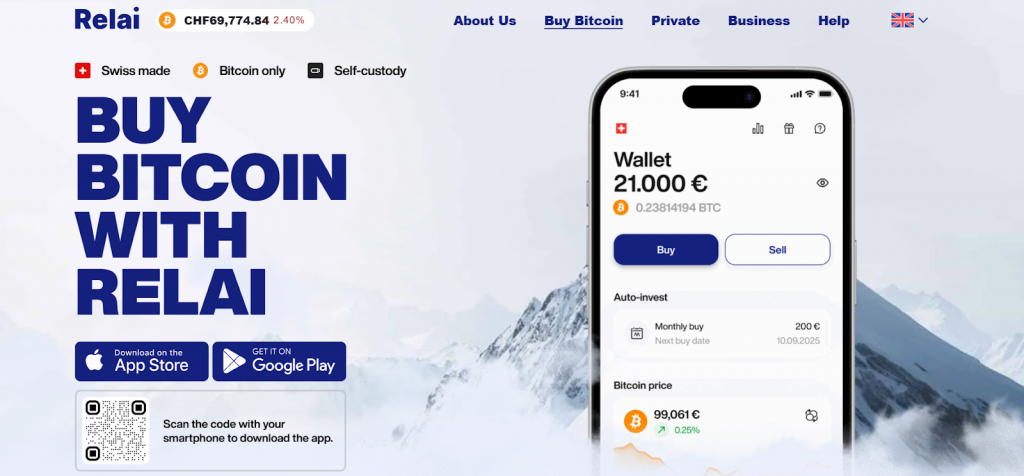

Relai

Relai is a regulated, Swiss-made, bitcoin-only investment app that is built to specifically serve European users. It focuses on simplicity and self-custody, which makes it popular with those who want to buy and hold bitcoin outside of an active trading environment or as one in a long list of altcoins.

The Relai app is designed around long-term savings rather than short-term speculation. It also has a strong emphasis on keeping bitcoin under user control (self-custody).

Key Features

Relai operates as a bitcoin-only app, which means users aren’t exposed to altcoins or complex trading tools. A central feature of the platform is its self-custodial wallet, where users retain control of their private keys from the moment of purchase, reducing reliance on third-party custody.

Bitcoin can be purchased as a one-time transaction or through automated weekly or monthly savings plans, which support a dollar-cost-averaging (DCA) approach.

Relai supports different European payment methods, including bank transfer and credit cards. You can also use mobile payment methods such as Google Pay and Apple Pay.

In addition to its retail app, Relai offers Relai Private for larger purchases and Relai Business for companies looking to hold bitcoin on their balance sheet.

Best Bits

- Bitcoin-only focus with no altcoins

- Non-custodial setup with user-controlled private keys

- Recurring buys that are designed for long-term accumulation

- European-focused product and compliant approach

Revolut

Revolut is a European fintech app that combines banking, payments, and investing in a single platform. Bitcoin is offered as one of many supported assets and not as a primary product or service.

Key Features

Bitcoin on Revolut is provided through a custodial model, with the platform generally managing storage on behalf of users. Investors can buy bitcoin as a one-time purchase or set up recurring buys from their Revolut account balance.

Purchases are typically done using funds on the platform. These funds are added using payment methods such as credit cards, depending on your country. Bitcoin access is integrated into the broader Revolut app alongside other financial products.

Best Bits

- Bitcoin access within a general-purpose finance app

- Custodial storage managed by Revolut

- Recurring purchase options available

- Suitable for users already using Revolut for banking

Bitpanda

Bitpanda is a Europe-based investment platform offering bitcoin alongside exposure to other cryptocurrencies, stocks, ETFs, and commodities. The app is built to cater to investors who want exposure to multiple asset classes within a single account.

Key Features

Bitpanda uses a custodial custody model, with bitcoin held on behalf of users. Investors can make one-time bitcoin purchases or set up recurring savings plans that may include bitcoin and other supported assets.

The platform supports several European funding methods, including bank transfers and credit cards, with availability depending on your specific location. Purchasing and accumulating bitcoin is part of a broader investment offering and not the primary focus, as it is on Relai.

Best Bits

- Bitcoin is available alongside traditional investments

- Recurring savings plans across multiple assets

- Broad range of European payment methods

- Single app for diversified portfolios

Key Factors When Comparing Bitcoin Apps in Europe

Here are factors you should consider when comparing apps for trading or accumulating bitcoin:

Custody Model

Custody is one of the most important differences between bitcoin apps. Non-custodial platforms allow you to control your private keys and hold bitcoin directly, while custodial platforms manage storage on your behalf. The right choice depends on whether you prioritize direct ownership or convenience.

Fiat On-Ramps and Payment Methods

Ease of funding plays a major role in picking the app to use. Support for familiar payment rails such as bank transfers, credit cards, Google Pay, and Apple Pay reduces friction and makes it easier to buy.

Bitcoin-Only vs Multi-Asset

Bitcoin-only apps focus on simplicity and long-term security. Meanwhile, multi-asset platforms provide broader exposure to cryptocurrencies and traditional investments. The trade-off is usually between focus and flexibility.

Recurring Buys and Savings Plans

Automatic weekly or monthly purchases can help you build positions over time without trying to time the market. This feature is particularly popular among those following long-term accumulation strategies.

Which App Wins?

The three apps on this list offer different, unique use cases. Relai stands out as the best bitcoin-only app, which is ideal for investors who prioritize self-custody and long-term accumulation. Revolut and Bitpanda are great options for users who want bitcoin exposure alongside other financial or investment products.