Bitcoin has been on a wild ride throughout the past few days, with bulls sending the cryptocurrency rocketing up to fresh all-time highs yesterday around $19,800 before losing their strength and succumbing to bears.

From here, the cryptocurrency’s price saw a vicious decline that sent it all the way down to lows of $18,200. The buying pressure here was quite intense and sparked a nearly instant rebound.

It rallied as high as $19,400 this morning before facing an influx of selling pressure that slowed its ascent and caused it to see a slight retrace. Nevertheless, it has still been able to post what appears to be a “V-shaped” recovery from these lows.

Where it trends next will likely depend largely on whether or not buyers can firmly reclaim $19,000 and establish this price as a long-term bottom. If it remains stuck below here, it could see continued weakness in the days and weeks to come.

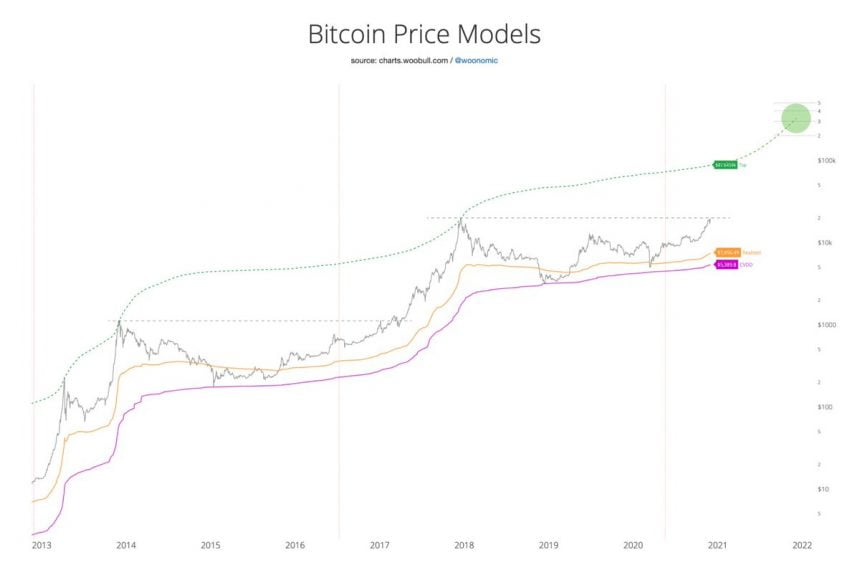

Despite this short-term turbulence, one economic model is still forecasting an incredibly bullish year for the benchmark cryptocurrency.

The on-chain analyst who developed the metrics that this model is premised upon concluded in a recent tweet that $200,000 per Bitcoin by the end of 2021 is a “conservative” prediction and that it could rally even higher.

Bitcoin Rebounds from Overnight Lows, But Bulls Lose Momentum

At the time of writing, Bitcoin is trading down just over 4% at its current price of $18,920. This marks a notable rebound from its overnight lows of $18,200 set following the recent rejection at $19,800.

From here, the crypto rallied as high as $19,400 before bulls lost their steam and the crypto’s price broke back below $19,000.

Where it trends next will likely depend fully on its continued reaction to this key level.

Economic Model Forecasts a 10x BTC Price Rise in 2021

One respected on-chain analyst explained in a recent tweet that one of his economic models predicts that Bitcoin is about to see some massive momentum.

He is now pointing to one of his economic models, which forecasts that Bitcoin could be trading between $200,000 and $300,000 by the end of 2021.

“Views on 2021: My Top Model suggesting $200k per BTC by end of 2021 looks conservative, $300k not out of the question. The current market on average paid $7456 for their coins.”

Image Courtesy of Willy Woo.

This prediction does seem to be a bit far-fetched, but if Bitcoin breaks above its all-time highs and sees price action similar to that seen during previous bouts of price discovery, a six-figure BTC could be right around the corner.

Featured image from Unsplash. Price data from TradingView.