The price of XRP is currently trading within an ascending parallel channel, indicating that a bullish move is imminent.

On a smaller time frame, Ripple is forming a bullish pennant, which might lead to a 47 percent gain.

Constant growth in daily active addresses implies that people are becoming more interested, which supports a positive outlook.

Over the last month, the price of XRP has been steadily increasing. Ripple has remained afloat despite the fact that most altcoins are retracing.

The price of XRP is expected to follow a similar upward trajectory in the future.

Three Reasons Why the Price of XRP Could Double in a few of Days:

From a long-term viewpoint, XRP has a bullish outlook

Since November 2020, the price of XRP has made greater highs and lower lows. The construction of an ascending parallel channel can be seen by drawing trend lines that connect these swing points. The vast scale of the pattern implies Ripple is on a journey from one end of the channel’s trend line to the other, despite the fact that a breakout from this technical formation is bearish.

Since pointing out the scenario, the price of XRP has risen 62 percent but has since retraced 12 percent to trade at $1.17.

When the remittance token bounced off the channel’s lower trend line the last two times, it eventually reached the channel’s upper ceiling. If the XRP price follows suit, it will have gained about 180 percent since its all-time high of $3.31.

This isn’t going to be a walk in the park. Before reaching the 2018 all-time high of $3.31, it will have to overcome $1.27, a harsh resistance barrier that has stymied its previous climb, as well as the $1.70 ceiling.

Ripple has formed a fair value gap (FVG) spanning from $1.30 to $1.60, which adds to the positive view (highlighted in orange). During the May 19 crisis, the XRP price dropped from $1.60 to $1.30 in a matter of seconds, leaving a gap and causing inefficiencies.

While the FVGs of several risky altcoins have already been filled, the XRP price has not. If the daily candlestick closes decisively above $1.30, a least-resistance path to $1.60 will be opened.

As a result, as Ripple breaks through the $1.27 supply barrier, market participants should expect further bullish action.

Short-term charts indicate that gains are on the way

Despite the fact that the longer time frame charts are positive, a closer look at the 4-hour chart reveals that the price of XRP is creating a bullish pennant.

The flagpole was generated by the 47 percent spike that occurred between August 12 and August 15, and the pennant was created by the continuous consolidation phase that followed.

By measuring the height of the flagpole and adding it to the breakout at $1.27, this continuation pattern indicates a 47 percent upswing to $1.87.

For the positive view to play out, a 4-hour candlestick close to over $1.27 is required.

A good breakout places the price of XRP slightly beyond the third hurdle at $1.87, paving the way to the 2018 all-time high of $3.31, as previously indicated.

Investor interest is growing

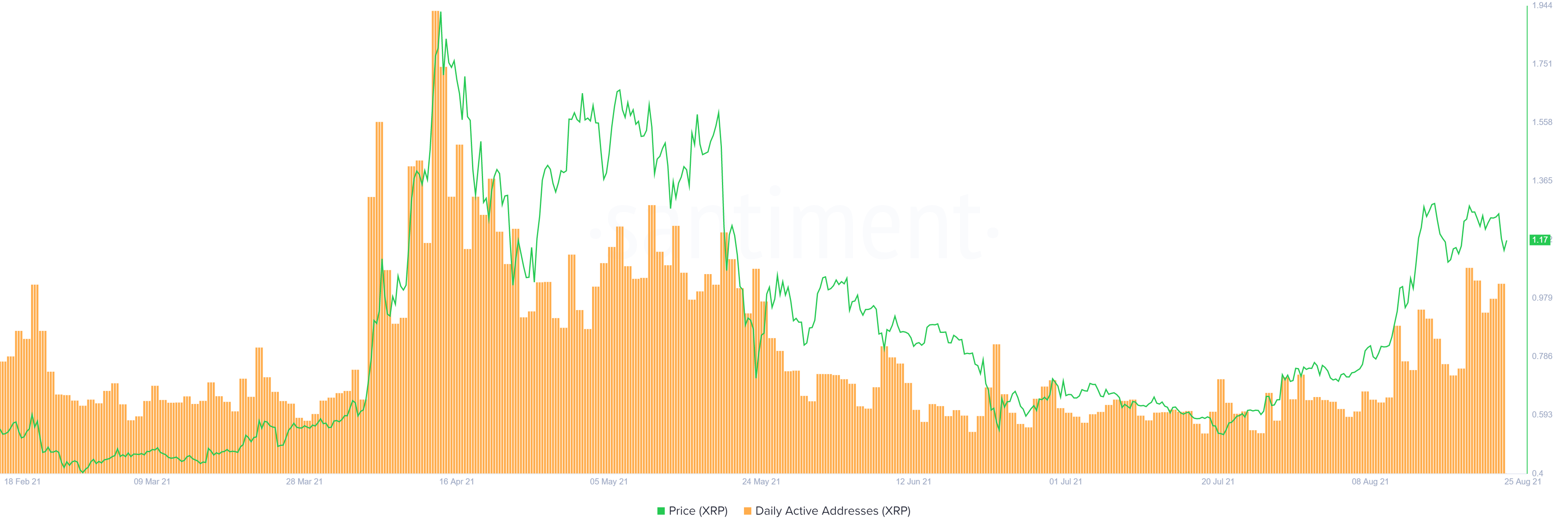

While the rise in the price of XRP is obvious, on-chain data shows that the number of users engaging with the XRP Ledger (XRPL) is steadily increasing.

On August 24, the number of daily active addresses on the XRPL increased from 9,233 on July 25 to 23,537. This 176 percent increase in users shows increased interest, which is a proxy for investor interest and a possible cash influx.

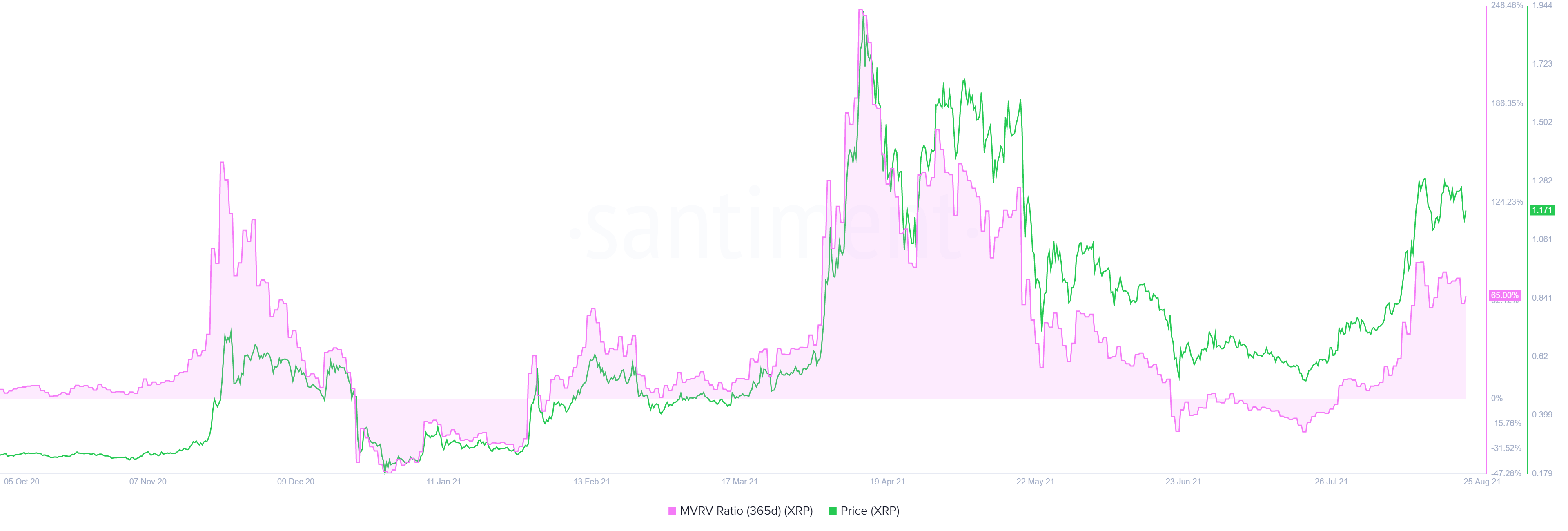

The positive forecast described above is contradicted by the 365-day Market Value to Realized Value (MVRV) model, which is now hanging around 64%.

This fundamental indicator measures the average profit/loss of XRP investors over the last 12 months. A high MVRV number implies that a big percentage of investors are profiting, which increases the risk of a crash if these investors realize their gains.

As a result, traders and holders must pay special attention to exchange inflows or a spike in large transactions, which are typically indicators of a flash crash.

As a result, a sudden increase in selling pressure might bring the price of XRP back to the $1.09 support level. If this barrier is breached, a bearish trend will emerge, with the chance of tagging the subsequent support floor at $0.90.

Ripple might make a swing low below $0.91 if momentum increases, undermining the bullish argument. In a negative scenario, the price of XRP might revisit $0.77, which would be a 30% drop from the $1.09 support level.

Source: FXSTREET