After China has reigned for a number of consecutive years as the dominant bitcoin mining epicenter of the world, the United States has “taken the leading position in bitcoin mining,” according to new data from Cambridge University.

Data Shows US, Kazakhstan, Russian Federation Rule the Bitcoin Mining Roost

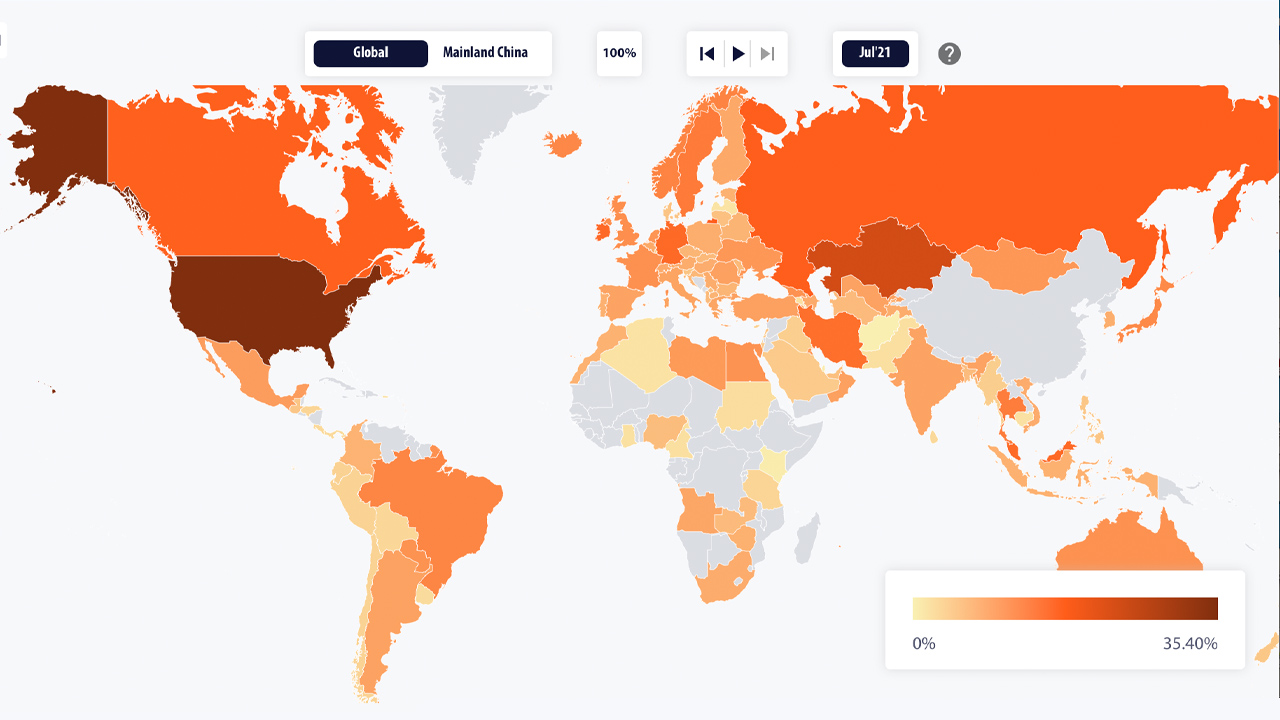

In mid-July, researchers from the Cambridge Bitcoin Electricity Consumption Index (CBECI) project published new data from the website’s “Bitcoin Mining Map,” which had not been updated since April 2020. In that specific report, CBECI researchers noted that China’s hashrate dominance was much lower than in previous estimates. On October 13, CBECI researchers published updated data on all the countries participating in bitcoin mining and where most of the mining activity is taking place these days.

“The latest update to the Cambridge Bitcoin Electricity Consumption Index (CBECI) has confirmed the impact of the Bitcoin mining crackdown in China,” the report detailed. “[It shows] that the leading share of global Bitcoin network hashrate now sits in the US, followed by Kazakhstan and the Russian Federation.” The CBECI researchers added:

This new data (to the end of August 2021) shows the US with a global hashrate share of 35.4% (up from 16.8% at the end of April), Kazakhstan with 18.1% (up from 8.2%), and the Russian Federation with 11% (up from 6.8%). This confirms the hashrate trajectory identified in the last update (to end April 2021) which showed those three countries were already gaining market share prior to the crackdown in China.

China’s Crackdown ‘Increased Geographic Distribution of Hashrate Across the World’

Since June 28, 2021, the Bitcoin network hashrate climbed 101.44% from 69 exahash per second (EH/s) to today’s 139 EH/s hashpower measurement. Michel Rauchs, digital assets lead at the Cambridge Centre for Alternative Finance, discussed how China’s crackdown helped fuel the shift in global bitcoin mining.

“The immediate effect of the government mandated ban on crypto mining in China was a 38% drop in global network hash rate in June 2021 – which corresponds roughly to China’s share of hashrate before the clampdown, suggesting that Chinese miners ceased operations simultaneously,” Rauchs suggested.

Besides the new top three countries leading the hashpower race, the next largest hashrate shares reside in countries like Canada (9.55%), Ireland (4.68%), Malaysia (4.59%), Germany (4.48%), Iran (3.11%), and Norway (0.58%). CBECI’s report highlights that while the U.S. got some hashrate from fleeing Chinese miners, the crackdown also “increased geographic distribution of hashrate across the world.”

“It is worth noting that the shares for Ireland and Germany are likely due to a growing number of miners rerouting through those countries via VPNs or proxy servers, rather than growing mining activity for which there is little or no evidence,” the CBECI report explains.

What’s also interesting is the fact that at least four out of the five top mining pools today originally stem from China and now many of them operate internationally and in unknown regions. F2pool, formally known as “Discus Fish” started mining bitcoin (BTC) on May 5, 2013, and was originally based in China.

F2pool commands 26.76 EH/s in hashpower and around 19.39% of the global hashrate today. Antpool, owned and operated by Bitmain, also initially came from China and is the second-largest hashing pool on October 13. Antpool captures 16.59% of the global hashrate with its 22.89 EH/s of hashpower. There’s also the top mining pools Viabtc and Poolin, which begs the question:

Where do these mining facilities and pools originate from now?

What do you think about the recently published Cambridge Bitcoin Electricity Consumption Index (CBECI) mining map report? Let us know what you think about this subject in the comments section below.

Bitcoin News

Mining, beijing, Bitcoin Mining Map, BTC.com, Canada, CBECI map, China, Chinese provinces, Foundry, Gansu, Germany, Iran, Ireland, Kazakhstan, Malaysia, Nei Mongol, Poolin, Qinghai, Russia, sichuan, university of cambridge, US, ViaBTC, Xinjiang, Yunnan, Zhejiang

1% Deposit Bonus & Withdrawal Fees On Crypto Deposit in BuyUcoin

Read More

A Decade in the Making: US SEC Approves 11 Bitcoin ETFs, Igniting Market Enthusiasm

Read More

Will Bitcoin Price Increase 200% When Bitcoin ETF Is Approved?

Read More

10 Must-Have Features on Bitcoin Staking Site

Read More

Christmas in the cryptocurrency world arrives early as the pre-holiday crypto market heats up

Read More