A group of U.S. banking regulators is working on how banks can be allowed to offer crypto services and hold cryptocurrencies on their balance sheets. The chairman of the Federal Deposit Insurance Corporation (FDIC) said, “If we don’t bring this activity inside the banks, it is going to develop outside of the banks … The federal regulators won’t be able to regulate it.”

US Regulators to Set Clear Rules for Banks to Deal With Crypto

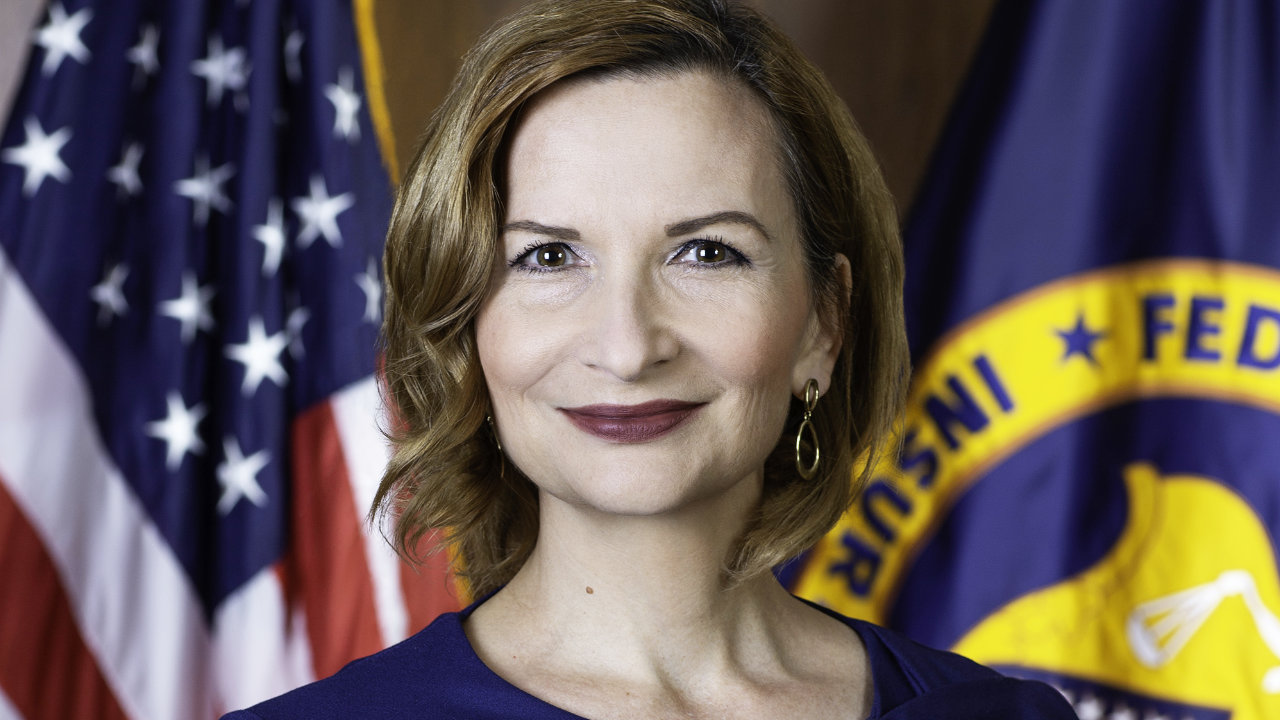

Jelena McWilliams, the chairman of the Federal Deposit Insurance Corporation (FDIC), told Reuters in an interview at a fintech conference Monday that a team of U.S. bank regulators is working on providing a roadmap for banks to engage with crypto assets.

The team comprises the FDIC, the Federal Reserve, and the Office of the Comptroller of the Currency (OCC). Federal Reserve Vice Chair of Supervision Randal Quarles revealed the collaboration between the three U.S. regulators in May.

McWilliams said on a conference panel:

My goal in this interagency group is to basically provide a path for banks to be able to act as a custodian of these assets, use crypto assets, digital assets as some form of collateral … At some point in time, we’re going to tackle how and under what circumstances banks can hold them on their balance sheet.

While establishing clear rules for banks to provide custody services is easy, the FDIC boss explained that it is difficult to figure out how to allow a volatile asset to be used as collateral and include it on bank balance sheets.

She was quoted as saying: “Valuation of these assets and the fluctuation in their value that can be almost on a daily basis … You have to decide what kind of capital and liquidity treatment to allocate to such balance sheet holdings.”

The OCC, under the leadership of Brian Brooks, clarified in June 2020 that national banks and federal savings associations can provide cryptocurrency custody services for customers. However, Brooks has resigned and the new Acting Comptroller of the Currency, Michael Hsu, has requested a review of the cryptocurrency standards established by the OCC prior to him taking office.

“I think that we need to allow banks in this space, while appropriately managing and mitigating risk,” McWilliams opined, elaborating:

If we don’t bring this activity inside the banks, it is going to develop outside of the banks … The federal regulators won’t be able to regulate it.

What do you think about banks holding cryptocurrencies on their balance sheets? Let us know in the comments section below.

Bitcoin News

Regulation, banks, banks holding bitcoin, banks holding crypto, bitcoin balance sheet, crypto balance sheet, custody service, FDIC, Federal Reserve, holding bitcoin, OCC