Chainlink’s price action as of late has been quite positive, with bulls shattering the resistance that previously sat around $12.00 and gaining momentum as the aggregated DeFi sector rebounds.

The cryptocurrency has held up quite well today despite some turbulence seen by Bitcoin and Ethereum.

The latest selloff seen by the benchmark cryptocurrency has come about due to positive news regarding the efficacy of a vaccine from Pfizer.

This news struck a blow to safe-haven assets, as it suggests that the global economic turmoil could soon come to an end.

Altcoins haven’t been hit too hard by this news, signaling that investors are growing more comfortable adding on risk by gaining exposure to high beta assets.

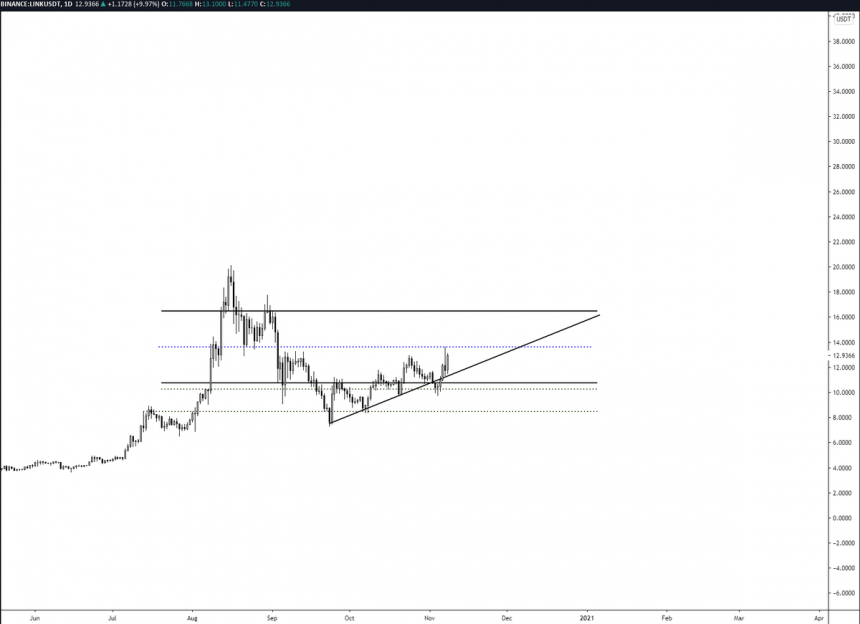

Chainlink is still on track to test its next key resistance at $13.00, and one analyst is noting that it could soon see significantly further momentum.

He is specifically watching for a move up towards $16.50, noting that it is still trading well-within a large triangle formation, and this marks the upper boundary of that pattern. A break above this level could lead to significantly further gains.

Chainlink Stable Below $13.00 as Bulls Guard Against Downside

At the time of writing, Chainlink is trading down just over 1% at its current price of $12.60. This is around where it has been trading throughout the past couple of days.

Last week, in tandem with the massive rallies seen by Yearn.finance’s YFI and other blue-chip DeFi tokens, LINK saw a sudden upswing that sent its price towards $14.00. The rejection here was intense and kicked off the ongoing consolidation phase.

Where it trends next will depend largely on whether or not bulls can surmount the selling pressure that exists at $13.00.

Analyst: LINK Likely to Surge Towards $16.50 Next

One trader recently offered an extremely bullish outlook on the cryptocurrency’s near-term price action, noting that it has yet to post any significant breakout and could soon rally towards $16.50 before finding any resistance.

A break above this level would cause it to break out of a bullish triangle formation it is currently caught within and lead to significantly further upside.

“Friendly reminder: LINK is another one that hasn’t even broken out yet and has a very strong Daily & Weekly chart. I’ll begin to take some profits on longs at $16.5. When LINK gets going…. it goes.”

Image Courtesy of UB. Source: LINKUSD on TradingView.

The coming days should provide some serious insights into where the cryptocurrency will trend in the next few weeks.

Featured image from Unsplash. Charts from TradingView.