It has been a wild past few days and weeks for the Yearn.finance governance token. YFI bulls attempted to spark a strong uptrend earlier this week when they surmounted the $18,000 level, as this has long been a macro resistance level for the cryptocurrency.

The break above this level was technically significant, which seems to be confirmed by the subsequent rally that sent the crypto surging up towards the mid-$20,000 region.

Despite the intense selloff seen yesterday by both Ethereum and Bitcoin, YFI has remained strong and is entering what appears to be another full-fledged bull trend.

It is now down roughly 50% from its all-time highs, and rising yields within the yVaults and a renewed sentiment amongst investors indicates that serious upside could be imminent in the days and weeks ahead.

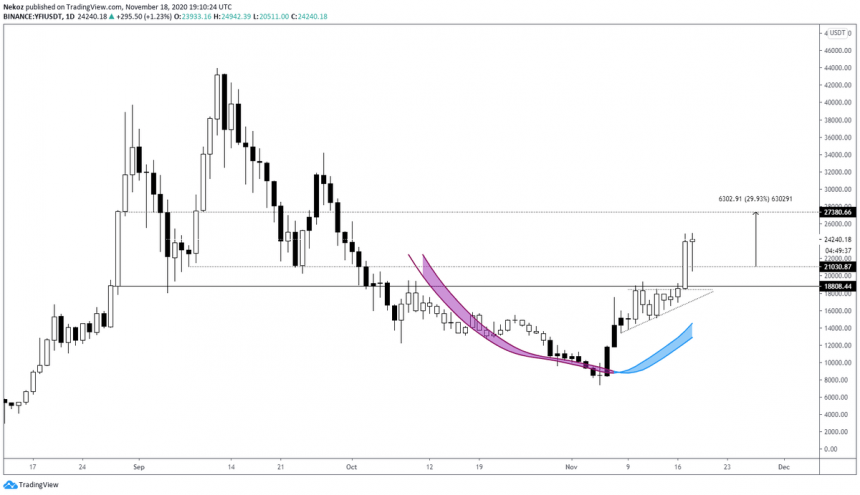

One trader is now noting that a move towards $27,000 could be imminent in the near-term.

He points to negative funding as a reason why upside is around the corner, noting that it indicates that there’s serious room for upside in the days ahead.

Yearn.finance Sees Explosive Upside Momentum

At the time of writing, Yearn.finance’s YFI token is trading up marginally at its current price of $24,000. This marks a massive rise from its recent lows of $7,500 set just a few days ago.

So long as it continues holding above the resistance-turned-support at $18,000, it may be able to see continued gains in the near-term.

It does appear to be facing some intense resistance around $25,000. Once this level is flipped to support, it may ascend to its previous all-time highs.

Unlike the summer DeFi rally, this latest one has come about in tandem with a rise seen by Bitcoin and Ethereum. It has also come about as investors focus their attention on higher-quality projects versus shiny new Uniswap listings with 10x potential.

Trader Claims YFI Will Likely Tap $27,000 Next

While sharing his thoughts on where Yearn.finance’s YFI token might trend in the near-term, one trader explained that he is watching for a move to $27,000.

He points to its negative funding rates as one reason why the crypto could see a strong push higher in the days and weeks ahead.

“YFI: No changes. Still expecting 27k all day long. Not to mention funding is still negative.”

Image Courtesy of NekoZ. Source: YFIUSD on TradingView.

Unless Bitcoin and Ethereum create any headwinds for the DeFi space in the days ahead, there’s a strong possibility that Yearn.finance’s YFI will continue pushing higher in the mid-term.

Featured image from Unsplash. Charts from TradingView.