Yearn.finance’s YFI token is surprisingly resilient today despite the turbulence throughout the aggregated crypto market. While Bitcoin is plunging lower, most of the DeFi sector is actually up today.

The break of this sector’s recent multi-month downtrend came about following a series of massive short squeezes seen by the blue-chip DeFi assets like YFI, SNX, and others.

Just a few days ago, YFI rallied from lows of $7,500 to $18,000 in a mere matter of hours, marking one of the largest surges seen by an asset of its size over such a short period of time.

After reaching these highs, it began encountering some intense selling pressure that slowed its growth and led it to see a sharp decline down to lows of $12,000. From this point, it rebounded and has been trading sideways ever since.

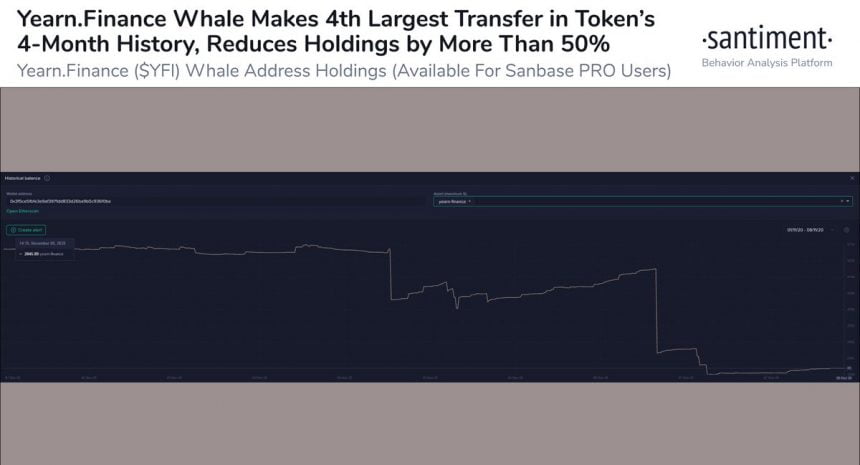

One bear-favoring event that may signal some downside is imminent for the token is the transference of 2,546.23 YFI tokens to a centralized exchange, marking the 4th largest transaction of all-time.

These tokens may soon be offloaded, placing immense sell-side pressure on the cryptocurrency.

Yearn.finance’s YFI Stabilizes Despite Bitcoin Downturn

Over the past couple of hours, Bitcoin’s weakness hasn’t done much to influence the DeFi sector’s price action.

Yearn.finance’s token is trading down roughly 2% at its current price of $14,780. This is around the price at which it has been trading throughout the past few days.

It is still down from its recent highs of $18,000 set at the peak of the short squeeze-induced rally, but it is still up nearly 100% from its weekly lows.

If BTC continues plunging lower, it could create some headwinds that hamper higher-risk cryptocurrencies like YFI.

YFI Just Saw Its 4th Largest Transaction Ever – And It’s Bad News for Bulls

According to one analytics platform, Yearn.finance’s YFI token just saw its 4th largest transaction ever, with someone sending over 2,500 tokens to an exchange.

This could indicate that a massive influx of sell-side pressure is imminent.

“We’ve just tracked Yearn.finance’s 4th largest transaction of all-time, and highest sum since late August. 2,546.23 YFI tokens were transferred as a centralized exchange deposit, worth a total of $13.8M from a whale address to new exchange address.”

Image Courtesy of Santiment. Source: YFIUSD on TradingView.

Just because these tokens are being moved to an exchange doesn’t mean that they’ll be sold, but it could be a potential event that catalyzes downwards momentum.

Featured image from Unsplash. Charts from TradingView.